What is the story about?

What's Happening?

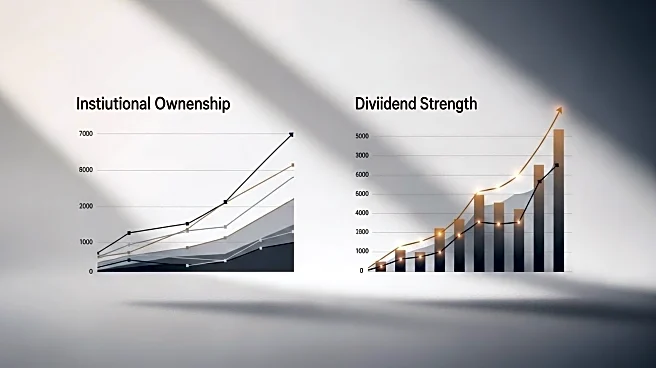

A. O. Smith Corporation and Murata Manufacturing are two large-cap industrial companies being compared for investment potential. A. O. Smith, headquartered in Milwaukee, Wisconsin, manufactures residential and commercial water heaters, boilers, and water treatment products. Murata Manufacturing, based in Japan, designs and sells ceramic-based electronic components. The comparison focuses on several factors including institutional ownership, dividends, volatility, profitability, and analyst recommendations. A. O. Smith has a higher institutional ownership at 76.1% compared to Murata's 0.8%, indicating strong confidence from hedge funds and large money managers. In terms of dividends, A. O. Smith offers a higher yield and has consistently raised its dividend for 31 years, making it a more attractive option for dividend-focused investors.

Why It's Important?

The comparison between A. O. Smith and Murata Manufacturing is significant for investors looking to diversify their portfolios with industrial stocks. A. O. Smith's strong institutional ownership suggests a robust market confidence, potentially leading to stable long-term growth. Its consistent dividend increase over decades provides a reliable income stream for investors. Murata Manufacturing, while having higher revenue and earnings, trades at a higher price-to-earnings ratio, making A. O. Smith a more affordable option. Analysts favor A. O. Smith due to its stronger consensus rating and potential upside, indicating it may outperform Murata in the near future. This analysis helps investors make informed decisions based on financial health and market performance.

What's Next?

Investors may continue to monitor A. O. Smith's performance, particularly its ability to maintain dividend growth and institutional support. Analysts predict a potential upside for A. O. Smith, suggesting further stock appreciation. Murata Manufacturing's focus on electronic components and solutions may attract investors interested in tech-related industries, but its higher valuation could be a deterrent. Both companies are expected to leverage their strengths in their respective markets, with A. O. Smith focusing on water heating and treatment solutions, and Murata on electronic components. Future earnings reports and market conditions will play a crucial role in shaping investor sentiment.

Beyond the Headlines

The comparison highlights broader trends in industrial investments, where companies with strong institutional backing and consistent dividend growth are favored. A. O. Smith's focus on water treatment and heating solutions aligns with increasing demand for sustainable and efficient energy solutions. Murata's expertise in electronic components positions it well in the growing tech industry, though its higher valuation may limit immediate investment appeal. The analysis underscores the importance of evaluating multiple financial metrics and market conditions when considering industrial stocks.