What is the story about?

What's Happening?

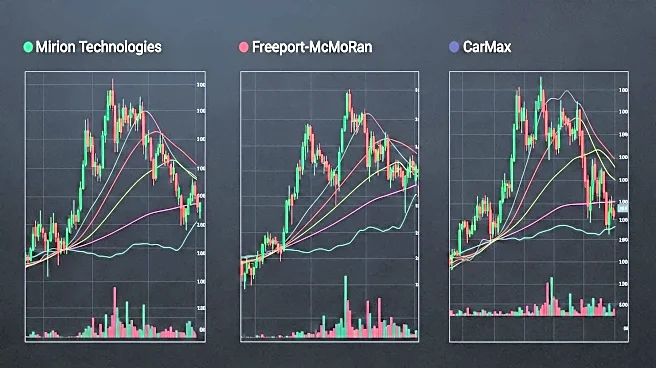

Several companies experienced notable stock movements midday, with Mirion Technologies falling over 8% after announcing a $300 million common stock offering and $250 million in convertible bonds. Freeport-McMoRan shares slid 5% following a force majeure declaration at its Grasberg mine in Indonesia. CarMax shares plummeted 19% due to disappointing quarterly results, reporting earnings of 64 cents per share, below the expected $1.04. Meanwhile, MP Materials saw a 10% increase, continuing its upward trend, and Intel shares rose 6% amid reports of potential investment talks with Apple.

Why It's Important?

These stock movements reflect broader market trends and investor sentiment. Mirion Technologies' stock offering indicates a strategic move to raise capital, which could impact its financial stability and growth prospects. Freeport-McMoRan's decline highlights the challenges faced by mining companies in managing operational disruptions. CarMax's disappointing results may signal challenges in the used car market, affecting consumer confidence and industry dynamics. Conversely, MP Materials' rise suggests strong investor interest in rare earths, driven by geopolitical and technological factors.

What's Next?

Investors will likely monitor Mirion Technologies' capital raising efforts and Freeport-McMoRan's operational challenges for potential impacts on stock performance. CarMax may need to address underlying issues affecting its earnings to regain investor confidence. The potential investment talks between Intel and Apple could lead to strategic partnerships, influencing the tech industry landscape.

Beyond the Headlines

The fluctuations in stock prices underscore the volatility in financial markets, influenced by corporate actions, geopolitical events, and investor sentiment. These movements may prompt companies to reassess their strategies and adapt to changing market conditions.