What's Happening?

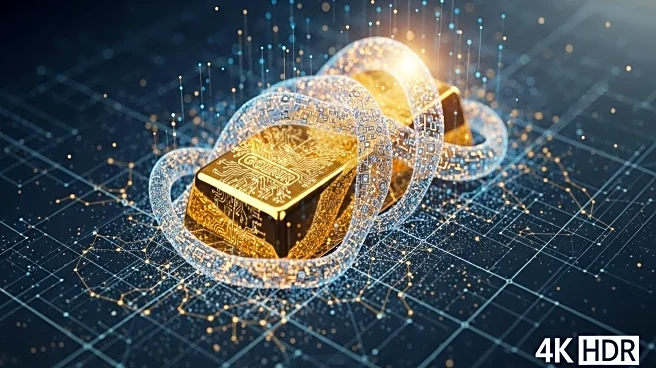

Tether, the issuer of the USDT stablecoin, has invested $205 million in gold-related ventures, including a $105 million stake in Elemental Altus and $100 million in mining and supply chain firms. This move marks a strategic shift towards integrating gold into digital asset collateral strategies. Tether's gold holdings, stored in Swiss vaults, are now part of a broader effort to tokenize real-world assets, enhancing transparency and trust through blockchain technology. The company's XAUt token, representing physical gold, is gaining traction on decentralized finance platforms, allowing users to leverage gold for loans.

Why It's Important?

Tether's investment underscores a growing trend of merging traditional commodities with digital finance, potentially reshaping how collateral is perceived and utilized. By tokenizing gold, Tether is democratizing access to a historically exclusive asset, offering new opportunities for both retail and institutional investors. This approach could mitigate risks associated with fiat currency volatility and Bitcoin price swings, providing a stable store of value. The move also reflects a broader industry shift towards decentralized financial systems, where transparency and accessibility are prioritized.

Beyond the Headlines

The tokenization of gold by Tether challenges conventional trust models, as blockchain technology offers real-time verification of reserves. This could attract institutional investors wary of traditional custodians, further integrating gold into digital ecosystems. The initiative also aligns with a larger narrative of decentralizing collateral, traditionally dominated by central banks and high-net-worth individuals. By bridging the gap between physical and digital assets, Tether is paving the way for a more inclusive financial system.