What's Happening?

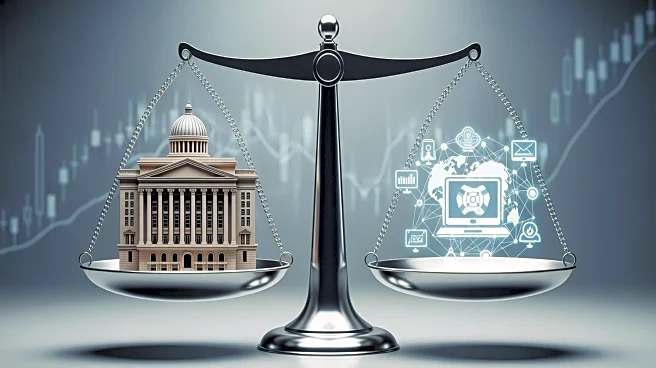

The European Commission has initiated an antitrust investigation targeting Deutsche Boerse and Nasdaq. The investigation focuses on potential violations of EU competition rules within the financial derivatives sector. The Commission suspects that these

companies may have engaged in non-competitive agreements or practices, including demand allocation, price coordination, and the exchange of commercially sensitive information. This probe is part of the Commission's broader efforts to ensure fair competition in the financial markets, particularly in the listing, trading, and clearing of financial derivatives.

Why It's Important?

This investigation is significant as it underscores the European Commission's commitment to maintaining competitive markets within the EU. If Deutsche Boerse and Nasdaq are found to have violated competition rules, it could lead to substantial fines and regulatory changes affecting their operations. The outcome of this probe could also influence market dynamics, potentially impacting investors and other stakeholders in the financial derivatives market. Furthermore, this action highlights the ongoing scrutiny of large financial institutions and their practices, which could lead to increased regulatory oversight in the sector.

What's Next?

The investigation will proceed with the collection and analysis of evidence to determine whether Deutsche Boerse and Nasdaq have indeed breached competition laws. Depending on the findings, the companies could face penalties or be required to alter their business practices. The financial industry and regulatory bodies will be closely monitoring the situation, as the results could set precedents for future regulatory actions. Stakeholders, including investors and other financial institutions, may need to adjust their strategies based on the investigation's outcomes.