What's Happening?

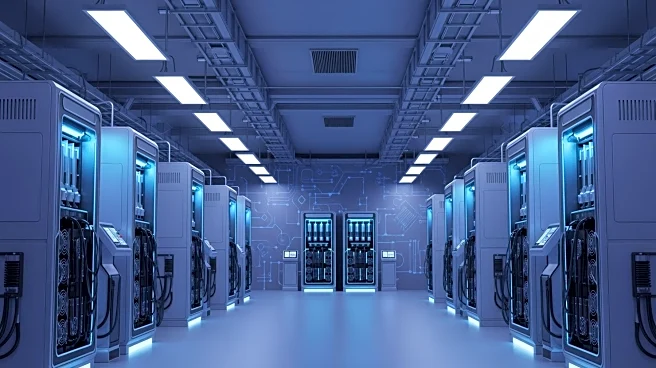

Phoenix Group, an Abu Dhabi-based cryptocurrency mining company, has announced the expansion of its mining capacity in Ethiopia by 30 megawatts (MW). This development is part of a partnership with Ethiopian

Electric Power, a state-owned energy company. The new facility, located in the Bole Lemi Industrial Park in Addis Ababa, is expected to add 1.9 exahashes per second (EH/s) to Phoenix's current hash rate. This expansion is a step towards the company's goal of scaling its capacity to 1 gigawatt (GW). Currently, Phoenix operates over 100,000 ASIC miners across five countries. The Ethiopian facility now accounts for roughly one-third of Phoenix's hash rate. However, the expansion comes at a time when the cryptocurrency mining industry is facing significant challenges. The Bitcoin price has corrected to around $100,000, and the hash price has fallen to $40-42 per terahash per second (TH/s) per day, pushing miners to the brink of profitability.

Why It's Important?

The expansion of Phoenix Group's mining capacity in Ethiopia highlights the growing interest in Africa as a viable location for cryptocurrency mining due to its relatively low energy costs. However, the industry is under pressure due to the current economic conditions affecting Bitcoin prices and mining profitability. The increased demand for electricity from miners has prompted Ethiopian authorities to plan a gradual increase in tariffs for businesses, which could impact the cost-effectiveness of mining operations in the region. The broader cryptocurrency mining industry is experiencing a liquidity crisis, with many miners selling off their Bitcoin holdings to stay afloat. This situation affects not only the miners but also the entire supply chain, including equipment manufacturers who rely on Bitcoin sales to sustain demand.

What's Next?

As the industry grapples with profitability challenges, stakeholders will be closely monitoring Bitcoin price trends and energy cost developments. The planned increase in electricity tariffs in Ethiopia could influence future investment decisions in the region. Additionally, the financial strategies of major mining companies, such as selling mined Bitcoins or securing loans against cryptocurrency holdings, will be critical in navigating the current economic landscape. The outcome of these strategies could determine the sustainability of mining operations and the potential for further expansion in Africa and other regions.