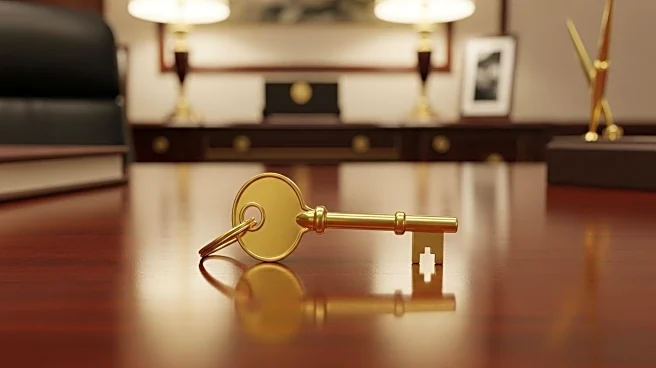

What's Happening?

Berkshire Hathaway, led by Warren Buffett, has announced the acquisition of Occidental Petroleum's chemical division, OxyChem, for $9.7 billion. This transaction is notable as it may represent Buffett's last major acquisition before he steps down as CEO in January, passing the role to Vice Chair Greg Abel. Buffett will continue as chairman and remain involved in strategic decisions. The acquisition of OxyChem, which produces chemicals like chlorine and vinyl chloride, complements Berkshire's existing portfolio, including Lubrizol, acquired in 2011. Occidental plans to use $6.5 billion from the sale to reduce its debt, aligning with its financial strategy following the CrownRock acquisition.

Why It's Important?

This acquisition is significant for several reasons. It marks a potential shift in leadership at Berkshire Hathaway, with Greg Abel poised to take over as CEO. The deal also highlights Berkshire's strategic focus on expanding its chemical industry footprint, which could enhance its long-term profitability. For Occidental, the sale is a strategic move to reduce debt, which could stabilize its financial standing. The transaction reflects broader market trends where high acquisition prices have limited major deals, making this a notable exception. Stakeholders in both companies, including shareholders and employees, stand to be impacted by these strategic shifts.

What's Next?

The OxyChem deal is expected to close in the fourth quarter of this year. As Greg Abel prepares to assume the CEO role, stakeholders will be watching closely to see how he steers Berkshire Hathaway's future acquisitions and strategic direction. Occidental's focus will likely remain on debt reduction and financial restructuring. The market will also be attentive to any further moves by Berkshire in the chemical sector, as well as potential changes in its investment strategy under new leadership.