What's Happening?

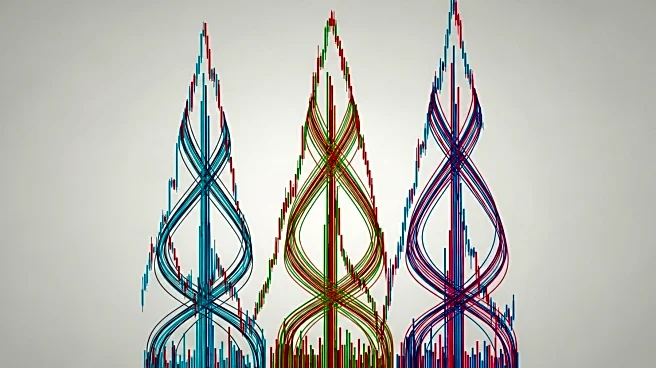

Jim Cramer, a prominent CNBC analyst, has highlighted the existence of three distinct stock markets currently operating on Wall Street. According to Cramer, these markets are behaving differently due to various factors, including speculative investments, technology-driven stocks, and traditional defensive stocks. The speculative market is seeing significant activity, with companies like Bloom Energy experiencing a surge after a deal with Brookfield. Additionally, rare earth miners are benefiting from JPMorgan's $1.5 trillion investment initiative in domestic industries. The tech-focused market is thriving, particularly with artificial intelligence companies, as evidenced by the Broadcom-OpenAI partnership, which has boosted Broadcom's stock. Meanwhile, the regular market, which includes consumer staples, is facing challenges, partly due to President Trump's social media posts on China that have influenced market sentiment.

Why It's Important?

The division of Wall Street into these three distinct markets reflects the broader economic and geopolitical uncertainties affecting investor behavior. The speculative market's activity suggests a high-risk appetite among investors, which could lead to increased volatility. The tech market's growth underscores the importance of artificial intelligence and technology partnerships in driving stock performance. However, the regular market's struggles highlight the impact of geopolitical tensions, such as the U.S.-China trade relations, on traditionally stable sectors. This segmentation could influence investment strategies, with stakeholders needing to navigate these varied market dynamics carefully.

What's Next?

Investors and analysts will likely continue to monitor the developments in these three markets closely. The speculative market may face risks if companies start issuing secondary stock offerings, potentially diluting share value. The tech market could see further growth if more partnerships and investments in AI and computing power emerge. Meanwhile, the regular market may stabilize if geopolitical tensions ease, but it remains vulnerable to external factors. Stakeholders, including financial advisors and policymakers, may need to adapt their strategies to address these evolving market conditions.

Beyond the Headlines

The segmentation of Wall Street into distinct markets raises questions about the sustainability of speculative investments and the long-term impact of technology-driven growth. Ethical considerations may arise regarding the influence of social media on market sentiment, particularly when posts from influential figures like President Trump can sway investor confidence. Additionally, the focus on domestic industries and critical minerals could have implications for U.S. economic policy and international trade relations.