What is the story about?

What's Happening?

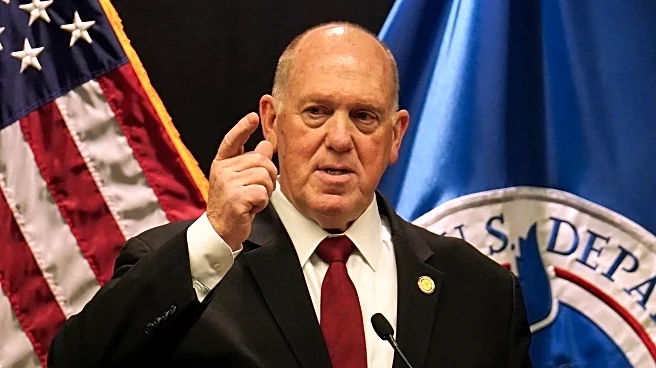

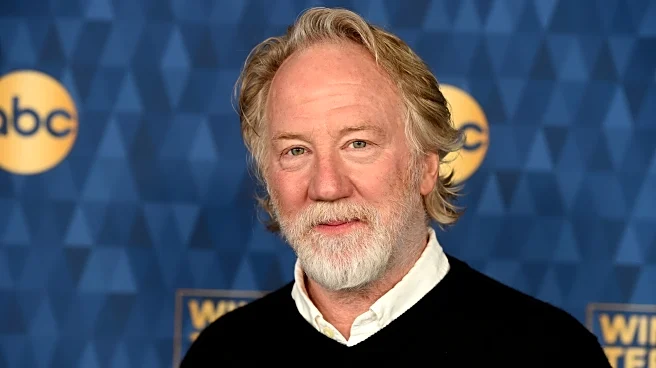

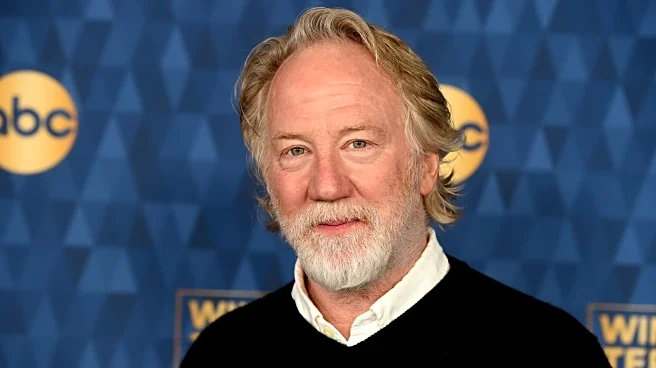

MEI Pharma, Inc. has rebranded as Lite Strategy, Inc., reflecting its shift towards digital asset treasury management. The company has adopted Litecoin (LTC) as its primary reserve asset, becoming the first U.S.-listed public company to do so. The rebranding includes a change in its NASDAQ ticker symbol from MEIP to LITS. This strategic move is supported by Charlie Lee, the creator of Litecoin, who is now a board member of Lite Strategy. The company aims to leverage Litecoin's reliability and scalability as part of its long-term corporate strategy, while continuing to evaluate its drug candidate pipeline.

Why It's Important?

The rebranding and strategic shift towards digital asset management mark a significant transformation for Lite Strategy, Inc. By adopting Litecoin as a primary reserve asset, the company is positioning itself at the forefront of integrating digital currencies into corporate treasury operations. This move could set a precedent for other public companies considering similar strategies, potentially influencing the broader adoption of cryptocurrencies in traditional financial systems. The involvement of Charlie Lee and GSR Ventures provides credibility and expertise, enhancing the company's market position and appeal to investors interested in digital assets.

What's Next?

Lite Strategy will continue to develop its digital asset treasury strategy, with GSR Ventures providing liquidity and risk management support. The company will also focus on its drug development pipeline, exploring new opportunities for its existing candidates. Investors and market analysts will likely watch for further developments in Lite Strategy's digital asset initiatives and their impact on the company's financial performance and stock valuation.