What's Happening?

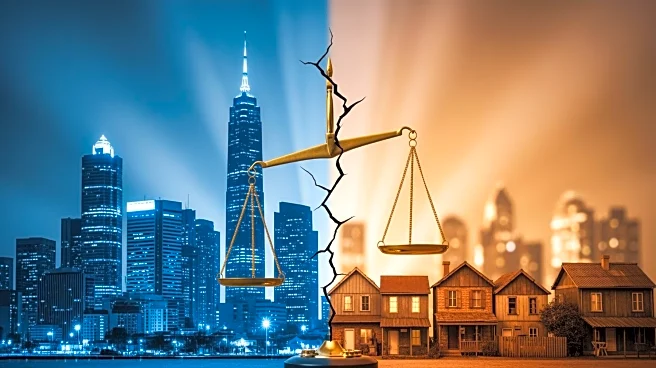

Bank of America Global Research analysts are advising investors to consider opportunities outside the AI sector. The focus on AI-related stocks, particularly semiconductor companies like Nvidia, may be overshadowing potential gains in other industries.

BofA has compiled a list of 16 'buy-rated' companies across various sectors, including communications, consumer discretionary, and financial services, which are not correlated to AI. These companies are valued below the S&P 500's multiple and have positive earnings revisions. The list includes Walt Disney, Amcor, AT&T, and others. BofA's Savita Subramanian warns that AI-driven efficiency could reduce demand for middle-income jobs, impacting consumer spending.

Why It's Important?

The recommendation to explore non-AI investments highlights the risks associated with the current AI market hype. As companies continue to invest heavily in AI infrastructure, there is a possibility of overvaluation and financial instability if AI monetization does not meet expectations. Diversifying investments can mitigate risks and provide stability in portfolios. The focus on non-AI sectors could lead to a more balanced market, encouraging investors to look beyond the tech industry for growth opportunities.

What's Next?

Investors may begin to shift their focus towards the companies identified by BofA, potentially leading to increased market activity in non-AI sectors. Companies on the shortlist might experience a rise in stock prices as investors seek alternatives to AI-related investments. The ongoing analysis of AI spending and its impact on the economy could influence future investment strategies and market trends.

Beyond the Headlines

The shift towards non-AI investments could have broader implications for the economy, including changes in employment patterns and consumer behavior. As AI technology continues to evolve, companies and investors must consider the long-term effects of their investment decisions on society and the economy.