What's Happening?

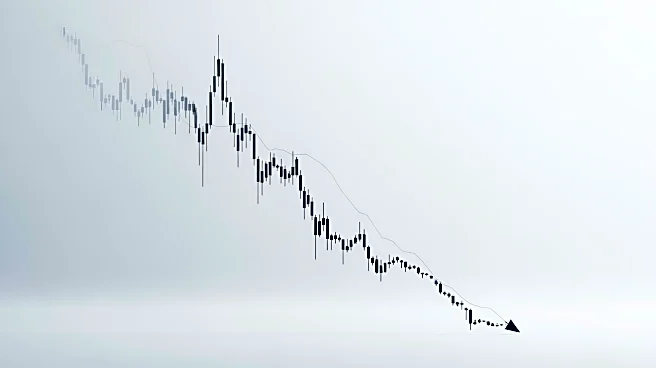

Oracle's stock has experienced a notable decline, dropping from $345.72 on September 9 to a low of $232.35, marking a 32.79% decrease over the past two months. This drop also represents a 50% retracement from its previous advance following a tariff-related

plunge in April. Analyst Carter Worth has suggested that this decline presents a buying opportunity for investors, anticipating a potential bounce in the stock's value.

Why It's Important?

The significant drop in Oracle's stock price could have implications for investors and the broader technology sector. As a major player in enterprise software and cloud services, Oracle's performance can influence market sentiment and investment strategies within the tech industry. A potential rebound, as suggested by analysts, might attract investors looking for value opportunities, impacting trading volumes and market dynamics.

What's Next?

Investors and market analysts will likely monitor Oracle's stock performance closely to assess the validity of the predicted rebound. Future earnings reports and strategic business decisions by Oracle could further influence stock movements. Additionally, broader economic conditions and industry trends may play a role in shaping investor confidence and stock valuation.