What's Happening?

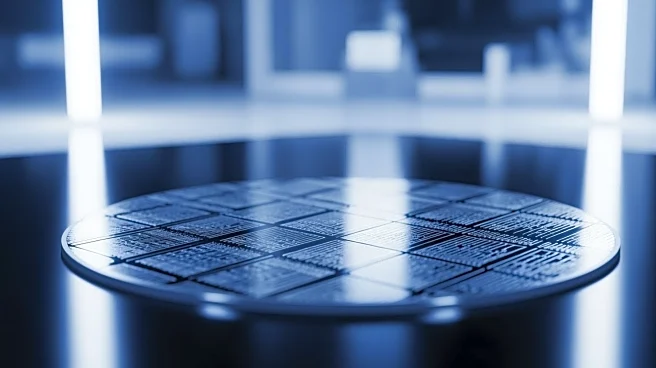

Crossmark Global Holdings Inc. has increased its investment in Taiwan Semiconductor Manufacturing Company Ltd. (TSM) by 3.2% during the second quarter, now holding 322,424 shares valued at $73.03 million. This move makes TSM the seventh largest holding in Crossmark's

portfolio. Other institutional investors have also adjusted their stakes in TSM, with some increasing their holdings significantly. TSM's stock performance has been strong, with a recent quarterly earnings report showing a 40.1% revenue increase compared to the previous year. The company has also announced a dividend increase, reflecting its robust financial health and investor confidence.

Why It's Important?

Taiwan Semiconductor Manufacturing is a key player in the global semiconductor industry, and its performance is closely watched by investors and analysts. The company's growth and strong earnings report indicate its resilience and ability to capitalize on the increasing demand for semiconductors. As institutional investors like Crossmark Global Holdings expand their positions in TSM, it underscores the company's strategic importance in the tech sector. TSM's success could have broader implications for the semiconductor market, influencing supply chains and technological advancements in various industries.

What's Next?

With TSM's continued growth and positive financial outlook, investors may look for further opportunities to increase their stakes in the company. Analysts have issued favorable ratings for TSM, suggesting potential for future stock appreciation. The company's strategic initiatives, including expanding production capabilities and enhancing technology offerings, could drive further growth. As the semiconductor industry faces challenges such as supply chain disruptions and geopolitical tensions, TSM's performance will be crucial in shaping market dynamics and investor sentiment.

Beyond the Headlines

TSM's expansion and investment growth highlight the increasing importance of semiconductors in the global economy, particularly in the context of technological innovation and digital transformation. The company's role in advancing semiconductor technology could influence developments in areas such as artificial intelligence, 5G, and IoT. Additionally, TSM's financial health and strategic positioning may impact broader economic trends, including trade relations and technological competitiveness. As the semiconductor industry evolves, TSM's leadership and innovation will be pivotal in driving future advancements.