What's Happening?

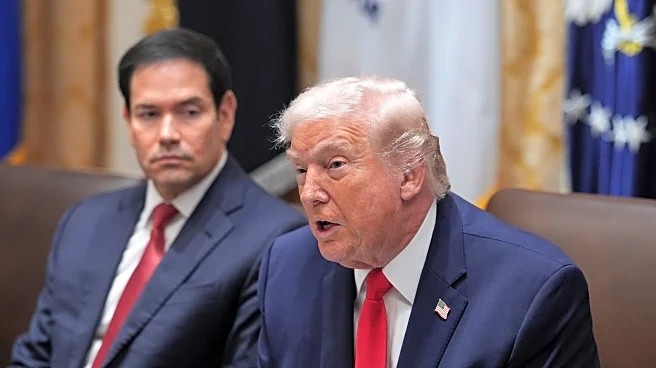

President Trump has announced a new trade deal with India, which includes a reduction in reciprocal tariffs from 25% to 18%. As part of the agreement, India will increase its purchase of American goods

and cease buying oil from Russia, opting instead to import from the U.S. and potentially Venezuela. This development has significantly boosted India's Nifty 50 index, which surged by 5% following the announcement. The trade deal is seen as a major external growth stimulus for the Indian economy in 2026, complementing the recently concluded India-EU trade agreement. The announcement also coincided with a rebound in Asia-Pacific markets, with South Korea's Kospi and Japan's Nikkei 225 showing significant gains.

Why It's Important?

The trade deal between the U.S. and India is poised to have substantial economic implications. By reducing tariffs and redirecting oil imports, the agreement strengthens economic ties between the two nations and potentially reduces India's reliance on Russian oil. This move could enhance U.S. energy exports and support American industries involved in oil production and export. Additionally, the deal may contribute to geopolitical shifts, as India aligns more closely with U.S. economic interests. The positive market reactions in Asia suggest investor confidence in the deal's potential to stimulate economic growth in the region.

What's Next?

The trade deal's implementation will likely lead to increased U.S. exports to India, particularly in the energy sector. Monitoring the response from other major oil exporters, such as Russia, will be crucial, as they may seek to adjust their strategies in response to India's shift in oil import sources. Additionally, the deal may prompt further negotiations between the U.S. and other trading partners, as countries reassess their trade relationships in light of shifting global alliances. The impact on global oil prices and market dynamics will also be an area of focus for economic analysts.