What's Happening?

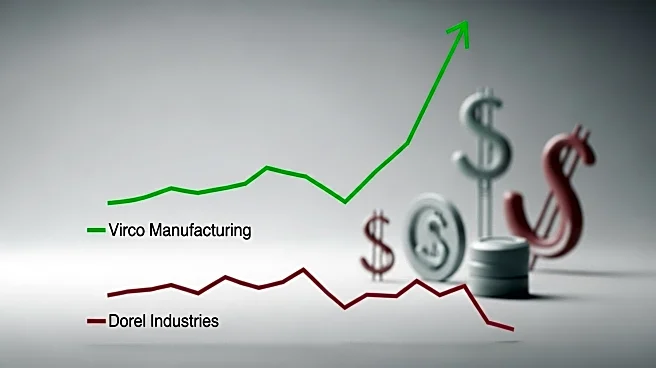

Virco Manufacturing, a company engaged in the design and distribution of furniture, has been highlighted in a financial analysis comparing it to Dorel Industries. The analysis reveals that Virco Manufacturing, listed on NASDAQ as VIRC, has a gross revenue of $236.93 million and a price/sales ratio of 0.55. In contrast, Dorel Industries, listed on OTCMKTS as DIIBF, has a gross revenue of $1.38 billion but a significantly lower price/sales ratio of 0.02. Virco Manufacturing also reported a net income of $21.64 million and earnings per share of $0.87, outperforming Dorel Industries, which reported a net loss of $171.96 million and negative earnings per share of $5.06. The analysis suggests that Virco Manufacturing is a more favorable investment, with a consensus price target indicating a potential upside of 106.81%.

Why It's Important?

The financial performance of Virco Manufacturing compared to Dorel Industries is significant for investors and stakeholders in the consumer discretionary sector. Virco's stronger financial metrics, including profitability and earnings, suggest a more stable and potentially lucrative investment opportunity. The company's higher institutional ownership indicates confidence from large investors, which can influence market perceptions and stock performance. This analysis may impact investment decisions, potentially leading to increased interest in Virco Manufacturing's stock. Conversely, Dorel Industries' financial struggles, highlighted by its negative earnings and high volatility, may deter investors, affecting its market position and future growth prospects.

What's Next?

Investors and analysts will likely continue to monitor the performance of both companies, particularly Virco Manufacturing, given its favorable financial outlook. The company's ability to maintain its profitability and meet or exceed its price target will be crucial in sustaining investor confidence. For Dorel Industries, addressing its financial challenges and improving its earnings will be essential to regain investor trust and stabilize its market position. Future financial reports and strategic decisions by both companies will be closely watched to assess their long-term viability and competitiveness in the market.

Beyond the Headlines

The comparison between Virco Manufacturing and Dorel Industries also highlights broader trends in the furniture and consumer goods industry. The emphasis on profitability and institutional ownership reflects a growing focus on financial stability and investor confidence in the sector. Additionally, the analysis underscores the importance of strategic positioning and market adaptability for companies operating in competitive industries. As consumer preferences and economic conditions evolve, companies like Virco and Dorel must navigate these changes to sustain growth and profitability.