What is the story about?

What's Happening?

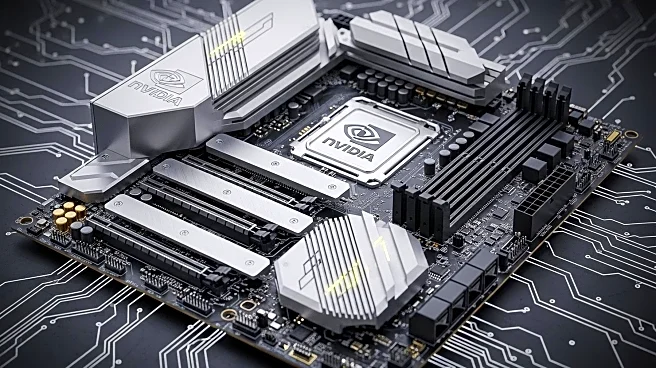

Intel has secured a $5 billion investment from Nvidia, making Nvidia one of Intel's largest shareholders with a 4% stake. This partnership aims to jointly develop PC and data center chips, potentially boosting Intel's capabilities in artificial intelligence and manufacturing. The deal has been positively received by Intel investors, resulting in a 23% increase in its share price. However, the implications for Asian chipmakers like Taiwan's TSMC and South Korea's Samsung Electronics are mixed. While Intel's revival could ease U.S. pressure on TSMC, it also introduces increased competition. TSMC currently dominates AI chip production for U.S. companies, and Intel's resurgence could alter this dynamic.

Why It's Important?

The partnership between Intel and Nvidia is significant for the semiconductor industry, particularly for U.S. national security and supply chain resilience. Intel's potential comeback could reduce the U.S. dependency on foreign chipmakers like TSMC, aligning with government interests to bolster domestic manufacturing. However, this development poses challenges for competitors such as AMD, which may face increased competition from Intel and Nvidia. The deal could also impact TSMC's business, as AMD might reduce its server CPU orders from TSMC. The broader implications include potential shifts in the global semiconductor manufacturing landscape, affecting market shares and strategic alliances.

What's Next?

The future of the semiconductor industry remains uncertain as Intel works to enhance its manufacturing capabilities. The partnership with Nvidia could eventually lead to Intel's involvement in manufacturing Nvidia's chips, posing a threat to TSMC's current role. Intel's ability to scale its foundry business will be crucial, as the U.S. government supports its efforts to become a leading semiconductor manufacturer again. Stakeholders will closely monitor how Intel's advancements affect its competitors and the global chipmaking landscape. The ongoing developments may lead to strategic adjustments by Asian chipmakers to maintain their market positions.

Beyond the Headlines

The Intel-Nvidia partnership highlights the geopolitical dimensions of semiconductor manufacturing, as U.S. policies aim to reduce reliance on foreign chipmakers. This move could trigger long-term shifts in manufacturing strategies and international relations within the industry. Ethical considerations arise regarding the balance between competition and collaboration among global tech giants. The deal underscores the importance of innovation and investment in maintaining technological leadership, influencing future industry standards and practices.