What's Happening?

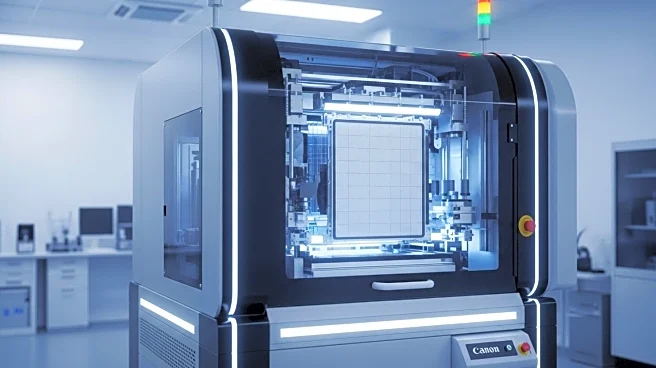

UBS has upgraded ASML, a Netherlands-based chipmaker, to a 'buy' rating, citing an upcoming inflection point in 2027. Analyst Francois-Xavier Bouvignies expressed optimism about ASML's lithography business, particularly its extreme ultraviolet (EUV) lithography machines, which are essential for advanced semiconductors. The anticipated increase in lithography intensity due to the production of TSMC's A14 logic node is expected to drive demand. ASML's work on the A14 production ramp will also boost the adoption of its High NA technology, contributing to long-term growth. Despite a year of underperformance, Wall Street remains bullish on ASML's demand strength, with earnings per share revisions climbing between 20% and 30% in the past year.

Why It's Important?

ASML's upgrade by UBS highlights the company's pivotal role in the semiconductor industry, particularly as the sole producer of EUV lithography machines. The anticipated inflection point in 2027 could significantly impact the semiconductor market, driving technological advancements and increasing production capabilities. ASML's strategic position and long product lead times make it integral to customers' long-term roadmaps, potentially influencing industry trends and competitive dynamics. The upgrade reflects confidence in ASML's ability to deliver strong earnings growth, reinforcing its status as a key player in the global tech landscape.

What's Next?

ASML is expected to continue its focus on the A14 production ramp and High NA technology adoption, positioning itself for growth as lithography intensity increases. The company's integration into customers' long-term roadmaps suggests sustained demand, despite potential short-term market challenges. Analysts anticipate ASML will deliver a 20% EPS CAGR from 2026 to 2030, reinforcing its reputation as a quality compounder. The company's shares have risen 8.7% this year, indicating positive market sentiment and potential for further growth.