What's Happening?

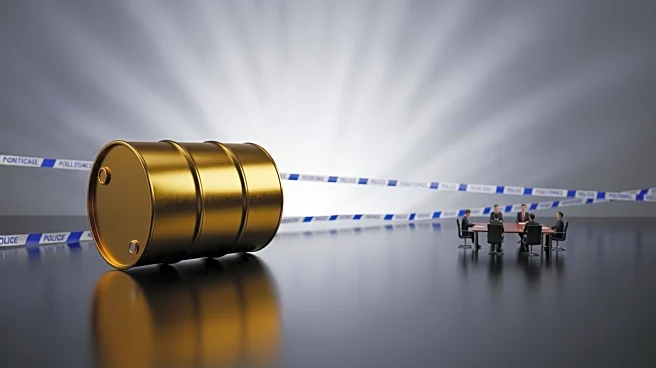

India's Oil and Natural Gas Corporation Limited (ONGC) has reported a 17.8% decline in net profit for the July-September quarter compared to the previous year, attributed to lower oil prices affecting

crude realizations. The company recorded a net profit of $1.11 billion for the second quarter of its 2025/2026 fiscal year. ONGC's crude realizations averaged $67.34 per barrel, down from $78.33 per barrel the previous year. Despite the decline, ONGC made two new oil and gas discoveries and drilled eight exploratory wells across various basins in India.

Why It's Important?

The decline in ONGC's net profit highlights the impact of fluctuating oil prices on major oil producers. As India's largest oil and gas producer, ONGC's financial performance is crucial for the country's energy security and economic stability. The company's efforts to boost production through new discoveries and well optimization are vital for reducing import dependence, which currently stands at 85% of total oil demand. Enhancing domestic production is essential for India's energy self-sufficiency and reducing vulnerability to global oil market volatility.

What's Next?

ONGC is committed to sustainable growth and energy security, focusing on increasing oil and gas production through well optimization and accelerating production at new discoveries. The company aims to reverse the gradual decline in production due to natural depletion. These efforts are expected to contribute to India's energy self-sufficiency and reduce reliance on imports. ONGC's strategic initiatives may also influence domestic energy policies and investment in the oil and gas sector.