What's Happening?

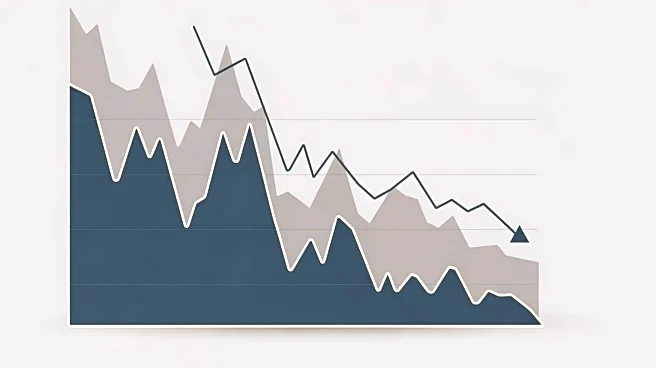

Meta Platforms experienced a significant stock dip following its Q3 earnings report, which highlighted rising capital expenditures and higher-than-expected expense growth for the upcoming year. Despite these concerns, the report showed strong revenue

growth and robust margins. The company's investments in AI-driven infrastructure, which were previously celebrated, are now causing investor apprehension. A non-cash tax charge further complicated the financial narrative, overshadowing the underlying strength of the quarter.

Why It's Important?

The stock dip reflects broader market concerns about Meta's spending strategy, particularly in AI and VR technologies. These investments are crucial for Meta's long-term growth, as they enhance engagement and ad performance. However, the increased expenditures have revived fears reminiscent of 2022, when similar spending led to margin compression and negative sentiment. The situation underscores the delicate balance Meta must maintain between innovation and financial prudence, impacting investor confidence and stock valuation.

What's Next?

Meta is expected to continue its focus on AI and VR, with plans for increased capital expenditures in 2026. The company aims to leverage its AI infrastructure to drive engagement and ad performance, potentially leading to long-term growth. Investors will be watching closely to see if these investments translate into tangible returns. Meta's ability to manage its spending while maintaining strong financial performance will be critical in restoring investor confidence and stabilizing its stock price.