What's Happening?

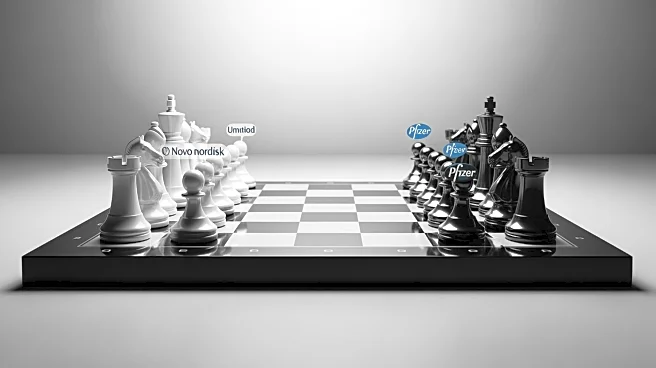

Metsera, Inc., a clinical-stage biotech company, is at the center of a heated bidding war between pharmaceutical giants Novo Nordisk and Pfizer. Novo Nordisk has offered $10 billion to acquire Metsera, valuing

its shares at approximately $86.20 each, which surpasses Pfizer's revised bid of $8.1 billion, valuing shares at $70. Metsera's board has declared Novo Nordisk's offer superior, citing a higher potential payout to shareholders. This decision follows Pfizer's initial agreement in September to acquire Metsera for $47.50 per share, plus contingent value rights. Novo Nordisk's counteroffer in late October prompted Pfizer to raise its bid and file lawsuits to enforce its deal. A Delaware judge has indicated she will not intervene in the bidding contest, allowing the market to determine the outcome.

Why It's Important?

The bidding war underscores the strategic importance of Metsera's obesity drug pipeline, particularly its lead candidate MET-097i, which has shown promising results in clinical trials. The acquisition of Metsera represents a significant opportunity for Novo Nordisk to strengthen its position in the obesity treatment market, potentially outpacing competitors like Eli Lilly. For Pfizer, acquiring Metsera would provide a crucial entry into the lucrative obesity drug market, which is projected to reach $150 billion annually by the early 2030s. The outcome of this bidding war could reshape the competitive landscape in obesity treatments, impacting market dynamics and investor sentiment.

What's Next?

Pfizer has until November 5, 2025, to counter Novo Nordisk's superior offer. If Pfizer fails to match or exceed Novo's bid, Metsera may terminate its agreement with Pfizer and proceed with Novo Nordisk. The ongoing legal and regulatory drama, including Pfizer's lawsuits against Metsera's board and Novo Nordisk, adds complexity to the situation. The Delaware judge's stance suggests the bidding war will continue without judicial intervention, potentially leading to further escalations in offer prices. Stakeholders are closely monitoring the situation, as the final decision will have significant implications for the involved companies and the broader pharmaceutical industry.

Beyond the Headlines

The intense competition for Metsera highlights the growing importance of obesity treatments in the pharmaceutical industry. Ethical and legal considerations, such as antitrust implications, are at play, given Novo Nordisk's dominant position in the obesity drug market. The outcome of this bidding war could set precedents for future mergers and acquisitions in the biotech sector, influencing how companies navigate competitive pressures and regulatory challenges. Additionally, the focus on obesity treatments reflects broader societal shifts towards addressing chronic health issues, with potential long-term impacts on public health policies and healthcare costs.