What's Happening?

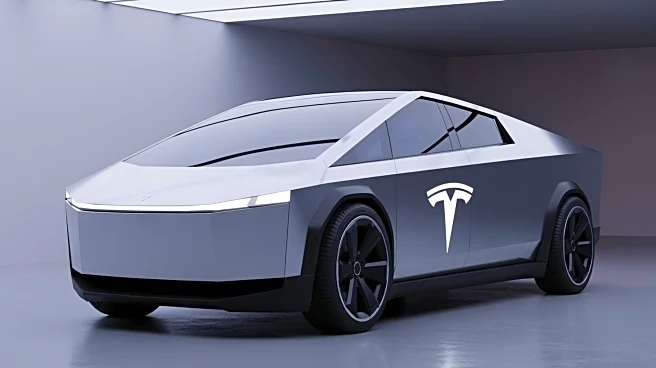

Tesla is set to report its third-quarter earnings, with investors keenly awaiting details on the long-teased Cybercab product. Despite this anticipation, CEO Elon Musk appears to be concentrating on his compensation

package and the upcoming Tesla shareholder meeting. Analysts expect Tesla's earnings per share (EPS) to drop by 24% to 55 cents compared to 72 cents in the third quarter of 2024, as per FactSet. The company's revenue performance will be closely watched, especially in light of the broader market dynamics and Tesla's strategic product developments.

Why It's Important?

The focus on the Cybercab product highlights Tesla's ongoing innovation in the electric vehicle sector, which is crucial for maintaining its competitive edge. Investors are particularly interested in how this new product could impact Tesla's market position and financial performance. Additionally, Elon Musk's focus on his pay package could influence shareholder sentiment and governance discussions. The anticipated drop in EPS may affect investor confidence, but the introduction of new products like the Cybercab could offset concerns by promising future growth and diversification.

What's Next?

Tesla's third-quarter earnings report will provide insights into the company's financial health and strategic direction. Investors will be looking for updates on the Cybercab product and any potential timelines for its release. The shareholder meeting may also address governance issues and Musk's compensation, which could lead to discussions on executive pay and corporate strategy. Stakeholders will be watching closely for any announcements that could impact Tesla's stock performance and market perception.

Beyond the Headlines

The development of the Cybercab product could signify a shift in Tesla's product strategy, potentially opening new market segments and driving innovation in urban mobility solutions. This move may also reflect broader trends in the automotive industry towards more sustainable and technologically advanced transportation options. The focus on executive compensation could spark debates on corporate governance and the balance between rewarding leadership and ensuring shareholder value.