What's Happening?

Coinbase CEO Brian Armstrong recently highlighted a potential vulnerability in prediction markets during the company's quarterly earnings call. On October 30, Armstrong humorously listed buzzwords such

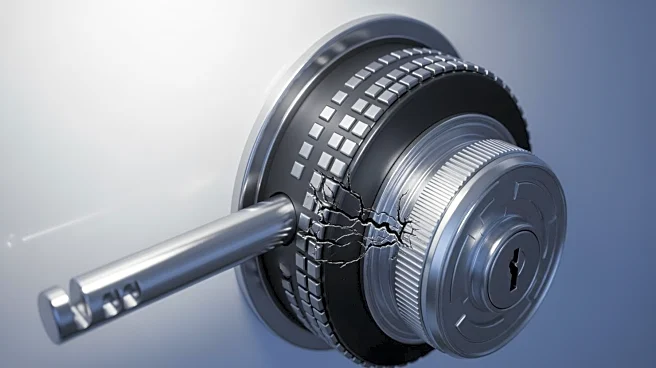

as 'Bitcoin, Ethereum, blockchain, staking, and Web3' at the end of the call. These terms were chosen based on bets placed by users on prediction market platforms like Kalshi and Polymarket, who speculated on what would be mentioned during the call. Armstrong's remarks, although made in jest, demonstrated how easily prediction markets could be influenced. By mentioning these terms, Armstrong affected the odds and payouts in an $84,000 betting market. Despite the lighthearted nature of his comments, Armstrong's actions underscored the potential for manipulation within prediction markets. Coinbase has policies prohibiting employees from participating in prediction markets related to the company, ensuring no internal benefit from such activities.

Why It's Important?

The incident involving Armstrong's remarks during the earnings call brings attention to the integrity and regulation of prediction markets. These markets allow users to bet on various topics, including corporate earnings calls, creating opportunities for manipulation. Armstrong's ability to influence the market by simply mentioning certain terms highlights the need for robust regulatory frameworks to prevent abuse. As prediction markets grow in popularity, ensuring their fairness and transparency becomes crucial. The Commodity Futures Trading Commission (CFTC) is already engaging with platforms like Kalshi to address regulatory concerns. This development could lead to more stringent oversight and policies to protect market participants and maintain the credibility of prediction markets.

What's Next?

The incident may prompt further discussions on the regulation of prediction markets, particularly concerning their susceptibility to manipulation. Platforms like Kalshi and Polymarket might face increased scrutiny from regulatory bodies like the CFTC. Coinbase's internal policies prohibiting employee participation in prediction markets could serve as a model for other companies to prevent conflicts of interest. As the conversation around prediction market regulation evolves, stakeholders, including regulators, market platforms, and companies, will likely explore measures to enhance market integrity and protect participants from potential exploitation.

Beyond the Headlines

Armstrong's remarks, while humorous, shed light on the ethical considerations surrounding prediction markets. The ability to influence market outcomes through seemingly innocuous actions raises questions about the ethical responsibilities of individuals and companies involved. As prediction markets intersect with corporate activities, maintaining ethical standards and transparency becomes vital to uphold trust and credibility. The incident may also spark broader discussions on the role of prediction markets in business and society, exploring their potential benefits and risks.