What is the story about?

What's Happening?

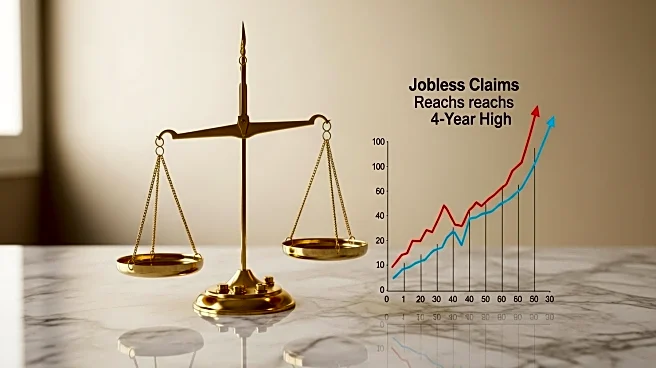

The U.S. Consumer Price Index (CPI) rose by 0.4% in August, marking the largest increase since January, driven by higher costs for housing and food. The CPI's year-on-year increase reached 2.9%, the highest since January. The rise in inflation is attributed to President Trump's tariffs, which have increased the prices of goods such as coffee and beef. Concurrently, weekly jobless claims surged to 263,000, the highest level since October 2021, indicating a weakening labor market.

Why It's Important?

The simultaneous rise in inflation and jobless claims presents a challenging scenario for the Federal Reserve, which is expected to cut interest rates next week. The combination of higher inflation and deteriorating labor market conditions raises concerns about stagflation, a situation characterized by slow economic growth and rising prices. This could impact consumer spending and economic stability, prompting the Fed to carefully consider its monetary policy approach.

What's Next?

The Federal Reserve is anticipated to cut interest rates at its upcoming policy meeting to address the economic challenges posed by rising inflation and unemployment. The rate cut aims to stimulate economic growth and mitigate the impact of tariffs on consumer prices. However, the Fed must balance these actions with the risk of further inflationary pressures.