What's Happening?

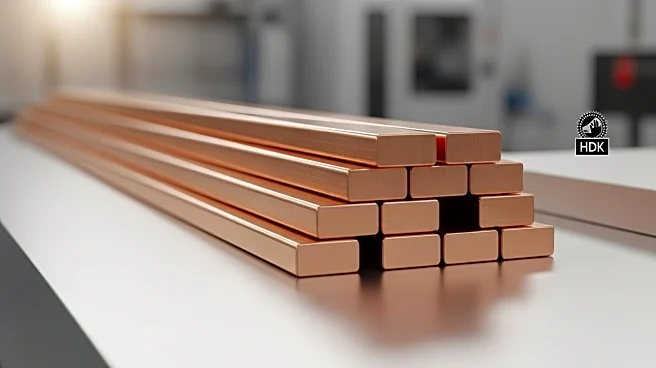

Teck Resources has revised its copper production outlook for its Quebrada Blanca (QB) and Highland Valley Copper operations due to slower tailings facility development and maintenance issues. The QB operation in Chile is expected to produce significantly less copper in 2025 and 2026 than previously forecasted. The company has also adjusted its cost forecasts, with potential further impacts if current initiatives do not succeed. Despite these challenges, Teck remains optimistic about the underlying potential of QB and its merger with Anglo American, which is expected to create synergies with nearby operations.

Why It's Important?

The revision in Teck's copper output forecast highlights the operational challenges faced by mining companies, particularly in managing tailings facilities. This development could impact the global copper supply and market prices, affecting industries reliant on copper. The merger with Anglo American is crucial as it promises to unlock additional value and create a more resilient copper producer. The situation underscores the importance of effective operational management and strategic partnerships in the mining sector.

What's Next?

Teck plans to continue addressing the tailings facility constraints and aims to improve production rates by 2027. The merger with Anglo American is expected to proceed, with both companies confident in the strategic benefits. Stakeholders will be watching closely to see how Teck manages its operational challenges and whether the merger delivers the anticipated synergies and financial benefits.