What is the story about?

What's Happening?

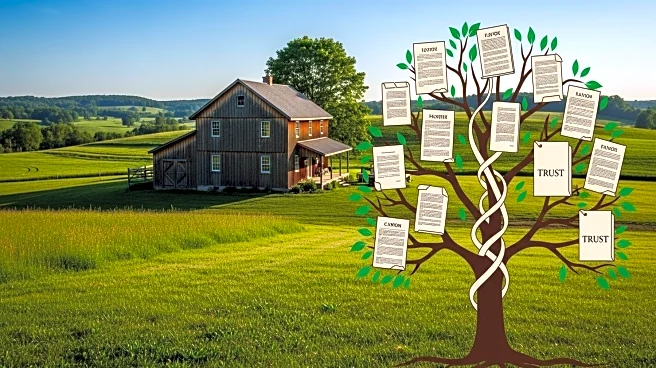

A farmer is facing challenges in creating a farm succession plan due to a testamentary trust established by his late wife. The trust, which holds half of every deed, divides the estate equally among their four children without provisions for farm succession. The farmer's son, who began farming full-time before his mother's death, was promised the 80-acre home farm and an option to buy other farms at a discount. However, the farmer is now unable to alter the distribution rules of the trust, complicating the succession plan. The farmer is exploring options to work around the trust's constraints, such as distributing his half of the farm to his son and adjusting the valuation of the land.

Why It's Important?

This situation highlights the complexities and potential pitfalls of estate planning for family farms. Trusts can create significant obstacles in succession planning, especially when they lack flexibility to adapt to changing circumstances. The inability to modify the trust's terms can lead to family disputes and financial burdens on heirs who wish to continue farming. This case underscores the importance of updating estate plans to reflect current family dynamics, land values, and tax laws. It also illustrates the need for clear communication and agreements among family members to ensure a smooth transition of farm ownership.

What's Next?

The farmer is considering several strategies to mitigate the impact of the trust on his succession plan. These include adjusting the valuation of his share of the estate to offer his son a deeper discount and encouraging family members to sign a binding agreement for the land purchase. The farmer must also prepare his children for potential changes to his will to avoid future conflicts. The outcome of these efforts will depend on the willingness of family members to cooperate and prioritize the continuation of the family farm.

Beyond the Headlines

This case reflects a broader issue faced by many farm families with outdated estate plans. As land prices and family dynamics evolve, rigid trust structures can hinder effective succession planning. The situation calls for a reevaluation of estate planning practices to ensure they accommodate the needs of future generations and preserve family legacies. It also highlights the ethical considerations of balancing individual family members' interests with the long-term viability of the family farm.