What is the story about?

What's Happening?

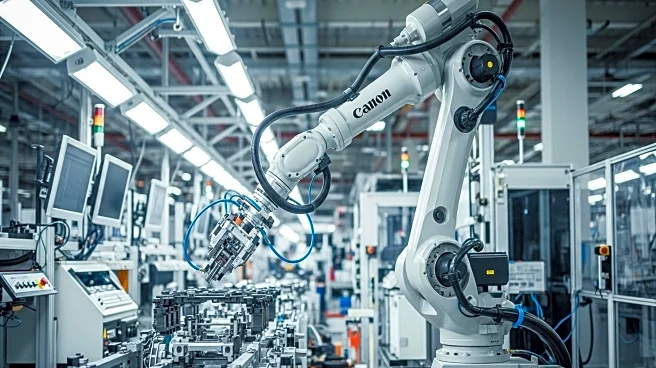

The automotive industry in the U.S. is facing significant challenges due to intensified immigration enforcement actions, which have exacerbated labor shortages in critical sectors such as semiconductors, steel, and logistics. The semiconductor industry, vital for modern automotive manufacturing, is projected to face a gap of 67,000 skilled engineering roles by 2030. This shortage is worsened by restrictive high-skilled visa pathways. Additionally, labor costs in steel and logistics sectors are expected to rise by 15-20% due to reduced immigration inflows, necessitating overtime pay and increased automation. These pressures are compounded by tariffs on Canadian and Mexican goods, destabilizing integrated North American supply chains under the USMCA. Automakers like Hyundai and Ford are experiencing operational risks from nearshoring and tariffs, with GM and Stellantis reporting significant losses from U.S. production shifts and halted Mexican operations.

Why It's Important?

The labor shortages and supply chain disruptions have broad implications for the U.S. automotive industry and its stakeholders. Automakers are forced to recalibrate production strategies, with nearshoring, automation, and vertical integration becoming essential for survival. These strategies, however, come with high capital expenditures and operational risks. Companies with robust contingency frameworks and ecosystem resilience strategies are emerging as more attractive long-term investments. Firms like Toyota and Honda are leveraging their U.S. manufacturing footprints to mitigate tariff risks while investing in automation to offset labor shortages. The ability of automakers to balance compliance with innovation is critical, as firms with diversified supply chains, strong R&D pipelines, and strategic partnerships are better positioned to withstand volatility.

What's Next?

The automotive industry's future will likely be defined by firms that prioritize resilience as a core competency. Immigration enforcement and trade policies create immediate headwinds but also incentivize innovation and strategic repositioning. Companies are expected to diversify geographically to mitigate tariff and labor risks, invest in automation and digital tools to enhance operational flexibility, and engage in scenario planning to prepare for regulatory and market shifts. As the industry navigates an era of uncertainty, the firms that adapt fastest will define the next decade of automotive manufacturing.

Beyond the Headlines

The shift toward electrification and autonomous driving requires capital-intensive investments, with companies like Tesla and Rivian prioritizing vertical integration and battery production. Their success hinges on securing critical minerals and managing geopolitical risks—a challenge that firms with weaker supply chain resilience may fail to address. Resilience is not just a risk management tactic but a competitive advantage in this volatile era.