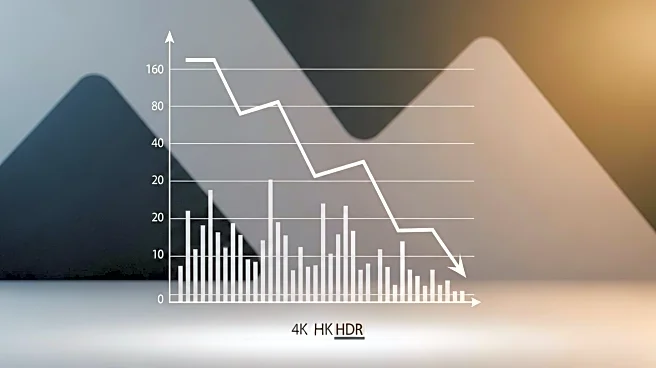

What's Happening?

The Institute for Supply Management's (ISM) Services Purchasing Managers Index (PMI) for September showed a decline to 50, down from 52 in August, indicating stagnation in the U.S. service sector. This figure fell short of market expectations, which anticipated a reading of 51.7. Despite the decline, the sector remains in expansion territory. The Employment Index rose slightly to 47.2, while the Prices Paid Index increased to 69.4, suggesting ongoing inflationary pressures. The U.S. Dollar experienced modest bearish pressure following the report, with the USD Index down 0.2% on the day.

Why It's Important?

The decline in the ISM Services PMI highlights challenges within the U.S. service sector, particularly in employment and inflation. The stagnation may signal potential headwinds for economic growth, as services play a crucial role in the overall economy. The persistent contraction in employment could influence Federal Reserve policy, potentially leading to interest rate adjustments. The report's impact on currency markets underscores the interconnectedness of economic indicators and financial stability. Stakeholders, including policymakers and investors, will need to consider these factors when assessing economic health and making strategic decisions.

What's Next?

The ISM Services PMI report's implications for monetary policy and economic strategy will be closely watched. The Federal Reserve may need to address employment challenges and inflationary pressures to support sustained growth. Market participants will continue to monitor macroeconomic data, especially in light of the ongoing U.S. government shutdown, which affects data collection and publication. The interplay between service sector performance and broader economic conditions will remain a focal point for analysts and decision-makers.