What's Happening?

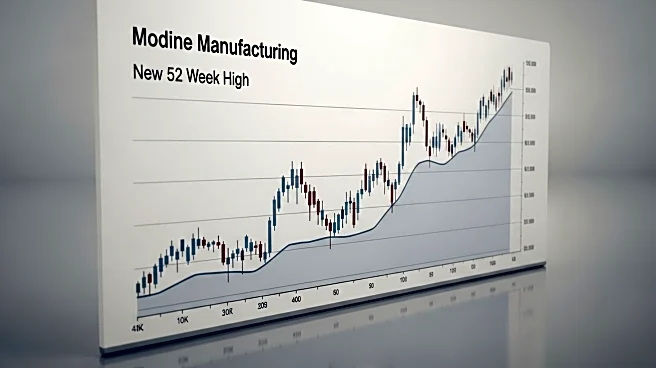

Modine Manufacturing Company, listed on the NYSE under the ticker MOD, has reached a new 52-week high, trading as high as $155.73 before settling at $152.52. This surge comes after several analysts raised their price targets for the company. KeyCorp increased its target from $150 to $160, maintaining an 'overweight' rating, while Oppenheimer raised its target from $121 to $122 with an 'outperform' rating. Despite a downgrade from Wall Street Zen to 'hold', the stock maintains a consensus 'buy' rating with a target of $145.67. Modine Manufacturing reported strong quarterly earnings, surpassing analyst expectations with $1.06 per share against a forecast of $0.93, and revenue of $682.80 million, up 3.2% year-over-year.

Why It's Important?

The rise in Modine Manufacturing's stock price reflects positive investor sentiment and confidence in the company's financial health and growth prospects. The company's ability to exceed earnings expectations and achieve revenue growth indicates robust operational performance. Analyst upgrades suggest potential for further stock appreciation, which could attract more institutional investors. The company's strategic focus on thermal management solutions positions it well in the auto parts industry, potentially benefiting from trends in energy efficiency and environmental sustainability.

What's Next?

Modine Manufacturing's future performance will likely be influenced by its ability to maintain growth momentum and meet or exceed financial forecasts. The company's fiscal year 2026 guidance and upcoming earnings reports will be critical in shaping investor expectations. Continued analyst coverage and potential further upgrades could drive stock price movements. Additionally, insider trading activities, such as recent stock sales by company directors, may impact investor perceptions and stock valuation.