What is the story about?

What's Happening?

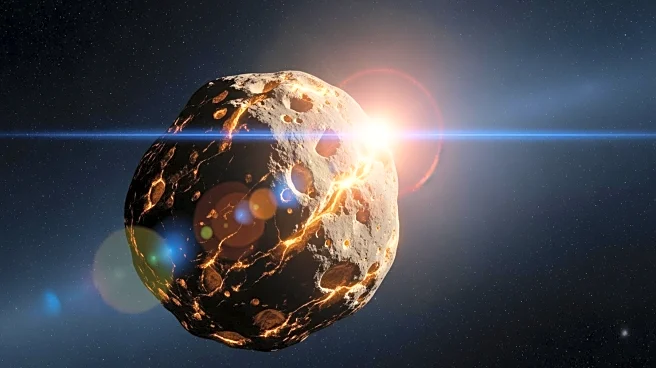

Gold prices are nearing the $4,000 per ounce milestone, driven by expectations of Federal Reserve rate cuts and safe-haven demand amid the ongoing U.S. government shutdown. Spot gold has reached an all-time high, with futures also surpassing the $4,000 mark. The rally is fueled by political and economic uncertainty, central bank purchases, and inflows into gold ETFs. The shutdown has delayed key economic indicators, prompting investors to rely on alternative data sources.

Why It's Important?

The surge in gold prices highlights the impact of political and economic instability on investor behavior. Gold is traditionally seen as a safe-haven asset during times of uncertainty, and its rising prices reflect a shift in investor sentiment. The demand for gold is supported by central bank purchases, providing a stable foundation for its value. This trend could have significant implications for financial markets, influencing investment strategies and economic policies worldwide.

What's Next?

Investors are anticipating further interest rate cuts by the Federal Reserve, which could support gold prices. The resolution of the U.S. government shutdown and political developments in France and Japan will be closely watched, as they could affect market sentiment and economic stability. As uncertainty persists, gold may continue to attract investment flows, reinforcing its role as a safe-haven asset.

Beyond the Headlines

The current gold rally may lead to long-term shifts in investment strategies, with more investors considering gold as a core component of their portfolios. The increased demand for gold could drive innovation in mining and production technologies, as companies seek to capitalize on favorable market conditions. Additionally, the geopolitical and economic factors influencing gold prices could have broader implications for global trade and monetary policies.