What's Happening?

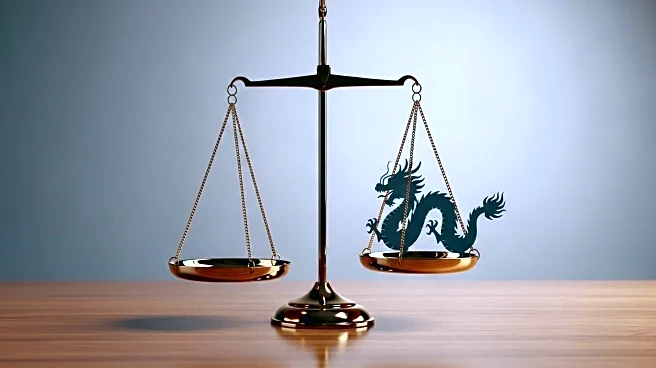

Recent legislative efforts by U.S. lawmakers, including Sen. Thom Tillis and Rep. Darrell Issa, have focused on curbing litigation funding, particularly targeting investments perceived to be backed by Chinese entities. The proposed legislation aimed to impose substantial taxes on 'qualified litigation proceeds,' making it financially burdensome for funders to invest in U.S. legal cases. Although these tax measures were removed from the final budget by the Senate parliamentarian, the initiative has sparked significant debate. Rep. Issa has raised national security concerns, suggesting that Chinese-backed funders could exploit the U.S. legal system. He advocates for fair and equal treatment within the justice system and aims to deter potential exploitation by foreign entities.

Why It's Important?

The scrutiny of litigation funding, especially with a focus on foreign investments, highlights ongoing concerns about national security and the integrity of the U.S. legal system. If successful, such legislative measures could significantly impact the landscape of litigation funding, potentially reducing foreign investment in U.S. legal cases. This could affect the ability of plaintiffs to secure funding for lawsuits, thereby influencing the dynamics of legal proceedings and access to justice. The debate also underscores broader geopolitical tensions and the influence of foreign capital in domestic affairs, raising questions about the balance between open investment and safeguarding national interests.

What's Next?

While the immediate legislative efforts to tax litigation proceeds have been halted, the issue remains contentious. Lawmakers may continue to explore alternative measures to regulate foreign investments in litigation funding. Stakeholders, including legal professionals and funding entities, are likely to engage in discussions to address these concerns while balancing the need for investment in legal cases. The ongoing debate may lead to further legislative proposals or regulatory actions aimed at ensuring transparency and security in litigation funding practices.

Beyond the Headlines

The focus on Chinese investments in litigation funding reflects broader concerns about foreign influence in critical sectors of the U.S. economy and legal system. This situation may prompt a reevaluation of how foreign capital is perceived and managed across various industries, potentially leading to stricter regulations and oversight. Additionally, the discourse around national security and foreign investments could influence public opinion and policy-making, affecting international relations and trade dynamics.

![Cortisol vs. Melatonin: The Biological War Happening Inside Every Night-Shift Worker]](https://glance-mob.glance-cdn.com/public/cardpress/binge-magazine-card-generation/spaces/US/en/discover-daily/images/ppid_7byehtbd-image-177082393426031154.webp)