What's Happening?

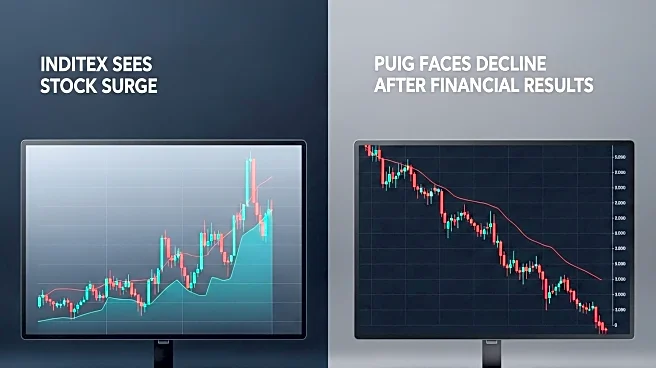

Inditex and Puig, two major players in the fashion industry, recently released their financial results for the first half of 2025, leading to contrasting reactions in the stock market. Inditex reported a slight increase in sales to 18.35 billion euros and a net profit rise to 2.79 billion euros. This positive performance led to a 6.51% increase in Inditex's share price, which continued to rise, reflecting investor confidence. Conversely, Puig, despite reporting a 5.9% increase in sales and a significant 79.13% rise in net profit, saw its share price fall by 6.98%. Analysts suggest the market's negative reaction to Puig's results may be due to the absence of a clear medium-term strategic plan and the terms of its IPO, which leaves the founding family with significant control.

Why It's Important?

The differing market reactions to Inditex and Puig's financial results highlight the critical role of investor confidence and strategic transparency in the fashion industry. Inditex's ability to maintain growth despite currency exchange challenges demonstrates resilience, which is rewarded by the market. On the other hand, Puig's lack of a publicly disclosed strategic plan may have led to investor uncertainty, impacting its stock negatively. These developments underscore the importance of clear communication and strategic planning in maintaining investor trust and market stability.