What's Happening?

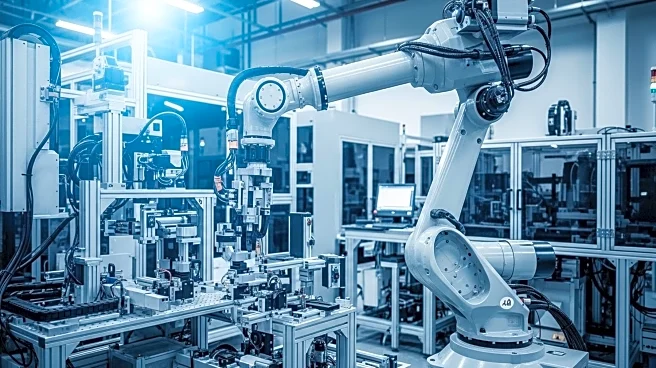

China has significantly advanced its automation industry, surpassing the U.S. in robot density and establishing large real-world AI data factories. According to the International Federation of Robotics, China received 54% of the 520,000 industrial robots installed worldwide in 2024, while the U.S. received only 7%. This shift is driven by China's state policies and its focus on technological leadership, with domestic vendors now holding over 50% of the industrial robot market. The country is also leading in electric vehicles, batteries, and drones, with application know-how increasingly flowing to Europe. Despite U.S. sanctions, China is progressing towards self-reliance in high-performance chips, and its investment in robotics and embodied intelligence has surged, with $3.4 billion invested in new ventures by July 2025.

Why It's Important?

China's rapid automation and AI advancements pose a significant challenge to U.S. manufacturing competitiveness. The U.S. risks losing its edge in physical AI, which could impact its position in the global robotics and AI race. The Association for Advancing Automation warns that without leadership in physical AI, the U.S. could fall behind in both robotics and AI. This situation highlights the need for the U.S. to enhance its industrial policy, focusing on rebuilding its manufacturing base, expanding STEM workforce training, and boosting R&D funding. The U.S. must also address dependencies on foreign suppliers for critical components and consider strategic partnerships to localize production.

What's Next?

The U.S. may need to implement the National Robotics Strategy, which includes establishing a central robotics office, offering tax incentives for automation adoption, and making the government a lead customer of robotics. Expanding STEM workforce training and updating standards for AI-driven machines are also recommended. These measures aim to counter China's momentum and ensure the U.S. remains competitive in the robotics and AI sectors. Additionally, rebuilding critical hardware supply chains and attracting foreign automation suppliers to co-locate in North America could help close the capability gap.

Beyond the Headlines

China's state-led model tolerates inefficiencies to secure strategic breakthroughs, which contrasts with the U.S. market economy that prioritizes efficiency and near-term returns. This difference in approach may influence the long-term competitiveness of both countries in the robotics and AI sectors. The U.S. must balance market discipline with strategic industrial policy to maintain its technological leadership. Furthermore, China's easing of skilled immigration rules and promotion of its tech stack as an affordable alternative for the Global South could shift global talent dynamics, impacting the U.S.'s ability to attract top talent.