What's Happening?

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) has experienced a notable increase in institutional investment, with Avantax Advisory Services Inc. boosting its holdings by 1.1% during the second quarter. Other major investors, including New Vernon

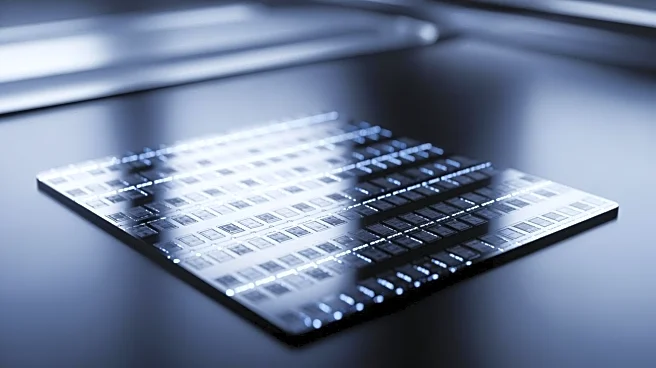

Capital Holdings II LLC and Goldman Sachs Group Inc., have significantly increased their positions in TSM, reflecting strong confidence in the company's performance. TSM has also announced an increase in its quarterly dividend, now set at $0.9678 per share, up from $0.83, indicating a positive outlook on its financial health. The company reported robust earnings for the last quarter, surpassing analysts' expectations, and has set optimistic guidance for the upcoming quarter.

Why It's Important?

The increased investment in TSM highlights the growing confidence in the semiconductor industry, which is crucial for technological advancements and economic growth. The dividend increase signals strong financial health and commitment to shareholder returns, potentially attracting more investors. As TSM continues to outperform expectations, it solidifies its position as a leader in the semiconductor market, impacting global supply chains and technological innovation. The company's performance and strategic decisions could influence market trends and investor behavior, affecting related industries and economic stakeholders.

What's Next?

TSM's continued growth and strategic investments may lead to further expansion and innovation in semiconductor technology. Analysts predict ongoing positive performance, with several maintaining a 'buy' rating on the stock. The company's future earnings reports and dividend announcements will be closely watched by investors and industry experts, potentially influencing market dynamics and investment strategies. As TSM navigates the competitive landscape, its actions could set benchmarks for other companies in the sector.