What's Happening?

Cleveland-Cliffs, an Ohio-based steelmaker, has seen a significant rise in its stock value following the announcement of a $400 million contract with the Defense Logistics Agency. This contract involves

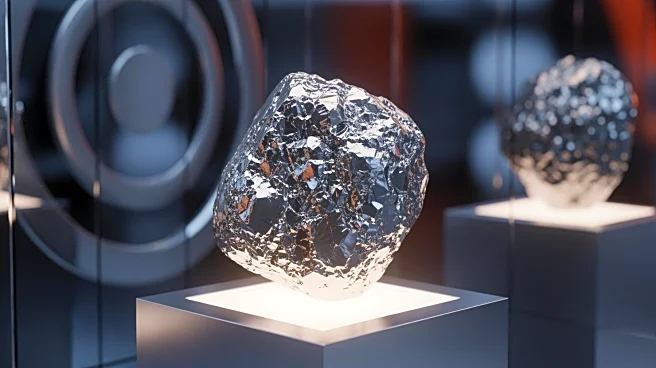

supplying steel for electrical transformers and generators over the next five years. Additionally, the company is exploring the potential for mining rare earth minerals at sites in Michigan and Minnesota. Cleveland-Cliffs reported a third-quarter revenue of $4.7 billion, slightly below investor expectations, and a net loss of $234 million. Despite this, the company's stock jumped nearly 20% due to increased demand for domestically produced steel, driven by tariffs imposed by President Trump. The company is also the sole U.S. producer of grain-oriented electrical steel, essential for the nation's defense and energy infrastructure.

Why It's Important?

The developments at Cleveland-Cliffs are crucial as they reflect the broader national strategy to enhance domestic production of critical materials, such as rare earth minerals and electrical steel. These materials are vital for national security and energy infrastructure. The company's efforts align with the U.S. government's focus on reducing dependency on foreign imports, particularly in strategic sectors. The potential expansion into rare earths could position Cleveland-Cliffs as a key player in the U.S. supply chain for these critical materials, supporting economic and industrial growth. The stock surge also indicates investor confidence in the company's strategic direction and its ability to capitalize on domestic market opportunities.

What's Next?

Cleveland-Cliffs plans to continue exploring its mining sites in Michigan and Minnesota for rare earth mineralization. The company has signed a Memorandum of Understanding with a global steelmaker to relocate production to the U.S., with a formal announcement expected soon. These initiatives could further strengthen Cleveland-Cliffs' market position and contribute to the U.S. strategy for critical material independence. The company's focus on expanding its role in the automotive and defense sectors is likely to drive future growth and investment.