What's Happening?

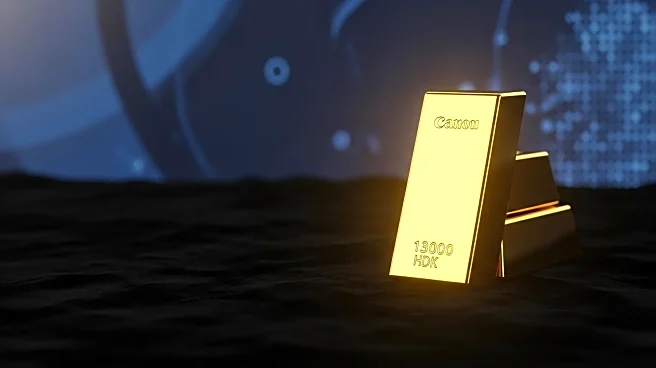

Gold has reached a historic milestone, surpassing $4,000 per ounce for the first time. This surge is driven by persistent inflation, global uncertainty, and strong institutional demand. The record-breaking price has led to speculation about Bitcoin's potential to follow suit, given its reputation as 'digital gold.' Investors are considering alternative assets as a hedge against traditional financial systems.

Why It's Important?

The rise in gold prices underscores a growing distrust in fiat currencies and traditional monetary systems. As central banks and institutional investors increase their gold holdings, the metal's appeal as a stable store of value is reinforced. This trend may influence Bitcoin's trajectory, as both assets are seen as hedges against economic instability. The interplay between gold and Bitcoin could shape future investment strategies.

What's Next?

Investors will be closely monitoring macroeconomic conditions and central bank policies that could impact gold and Bitcoin prices. The potential for Bitcoin to experience a similar rally will depend on market sentiment and institutional interest. As the global shift toward hard assets accelerates, both gold and Bitcoin may attract increased capital inflows.