What's Happening?

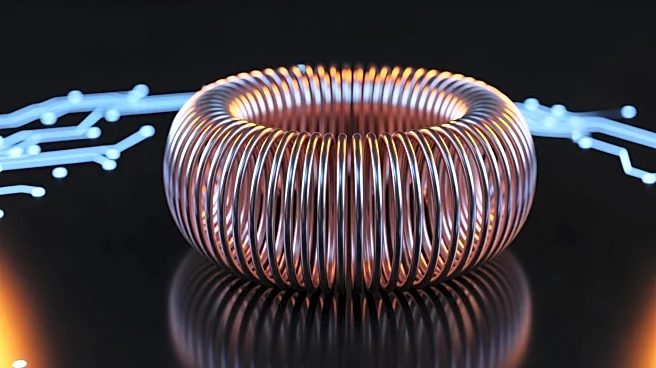

Copper has become increasingly critical for artificial intelligence (AI) data centers, driving up its demand and price. Copper futures have risen by 26% in 2025, with mining stocks experiencing even greater

gains. The Global X Copper Miners ETF, which includes a diverse range of copper mining companies, has seen a 66% increase this year. The Trump administration has added copper to the list of critical minerals, highlighting its importance for national security and economic growth.

Why It's Important?

The surge in copper demand underscores its vital role in supporting AI infrastructure, which is expected to consume more electricity and require more copper in the coming years. This trend presents significant investment opportunities, as copper prices are anticipated to continue rising. Investors looking to capitalize on the AI boom may consider investing in copper-related assets, such as the Global X Copper Miners ETF. The growing deficit in copper supply could further drive prices up, benefiting those who invest early.

What's Next?

As AI technology continues to expand, the demand for copper is likely to increase, potentially leading to further price hikes. Investors may explore various avenues to invest in copper, including futures, ETFs, and mining stocks. The industry will need to address supply challenges to meet growing demand, which could involve increased exploration and production efforts. Policymakers may also focus on securing copper resources to support technological advancements and economic growth.