What's Happening?

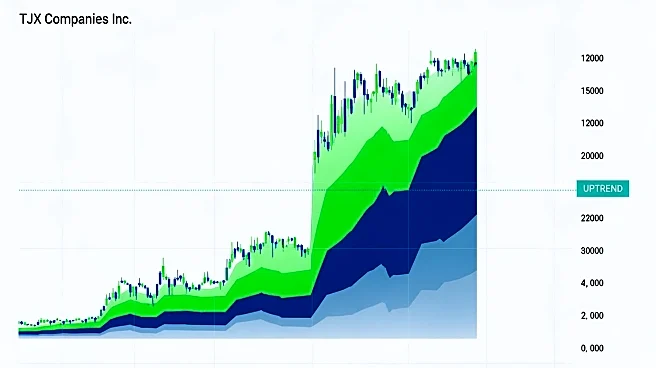

TJX Companies Inc., a prominent discount retailer, is showing signs of entering a new uptrend phase according to recent market analysis. The company has been experiencing a steady increase in stock prices, marked by a successful retest of key moving average

support. This development follows a breakout in August, where TJX surpassed its previous high from May, driven by strong volume characteristics and a long-term secular uptrend on the weekly chart. The stock's resilience is further demonstrated by its ability to maintain momentum, with the Relative Strength Index (RSI) remaining above the critical level of 40 during tests of the 50-day moving average. Additionally, the accumulation-distribution line has been in a consistent uptrend since June, indicating supportive volume for the cyclical price increase. The Chaikin Money Flow (CMF) also remains above zero, suggesting continued accumulation and potential for further price gains.

Why It's Important?

The emerging uptrend in TJX Companies Inc. is significant for investors and the retail industry, as it highlights the potential for sustained growth in the discount retail sector. This trend could attract more investors looking for stable returns in a volatile market environment. The strong market indicators suggest that TJX is well-positioned to capitalize on consumer demand, particularly as economic conditions fluctuate. The company's ability to maintain its stock price momentum and support levels indicates robust investor confidence and effective risk management strategies. This development may also influence other retail stocks, encouraging a broader market shift towards discount retailers as viable investment options.

What's Next?

If TJX Companies Inc. continues to maintain its current trajectory, investors may see further price gains, supported by ongoing accumulation and favorable volume characteristics. The company will likely focus on sustaining its long-term uptrend by leveraging its market position and consumer demand. Analysts and investors will be closely monitoring the stock's performance, particularly its ability to hold above the 50-day moving average. Should TJX experience a pullback, the 200-day moving average could serve as a critical support level, offering potential buying opportunities for investors seeking to capitalize on the company's growth prospects.

Beyond the Headlines

The sustained uptrend in TJX Companies Inc. may have broader implications for the retail industry, particularly in terms of consumer behavior and market dynamics. As discount retailers gain traction, traditional retail models may face increased pressure to adapt to changing consumer preferences. This shift could lead to a reevaluation of pricing strategies and inventory management across the sector. Additionally, the focus on technical market indicators highlights the importance of data-driven investment strategies, which may influence how investors approach retail stocks in the future.