What's Happening?

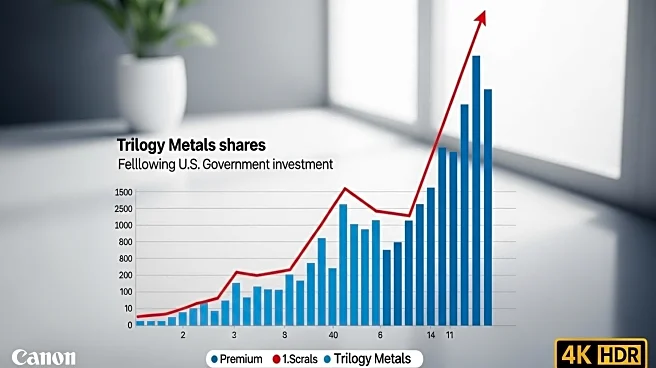

Shares of Trilogy Metals, a Canadian mining firm, soared by 215% after the U.S. government announced a 10% stake in the company. This $35.6 million investment is part of a strategic move by President Trump to secure domestic supplies of critical minerals, such as copper, to compete with China's dominance in the sector. Trilogy Metals holds interests in two significant mineral projects in Alaska, including the Ambler Road project, which had previously been rejected by the Biden administration. The U.S. government's involvement includes warrants to purchase an additional 7.5% of the company, reflecting a commitment to bolster domestic mineral supply chains.

Why It's Important?

The U.S. government's investment in Trilogy Metals is a strategic effort to reduce reliance on foreign sources for critical minerals, which are essential for energy infrastructure, defense technologies, and manufacturing. This move is particularly significant as it aims to counter China's control over the global supply chain of rare earth elements. By investing in domestic projects, the U.S. seeks to enhance its energy security and support the growth of clean energy initiatives. The decision also signals a shift in federal policy towards supporting resource development in Alaska, which could have broader implications for the U.S. mining industry.

What's Next?

The U.S. government's stake in Trilogy Metals is likely to prompt further investments in domestic mineral projects, as the country seeks to secure its supply chain for critical minerals. This could lead to increased exploration and development activities in Alaska and other resource-rich regions. Environmental concerns related to the Ambler Road project may also resurface, potentially leading to legal and regulatory challenges. The U.S. may continue to pursue similar investments in other mining companies to diversify its sources of critical minerals, aligning with broader national security and economic goals.