What is the story about?

What's Happening?

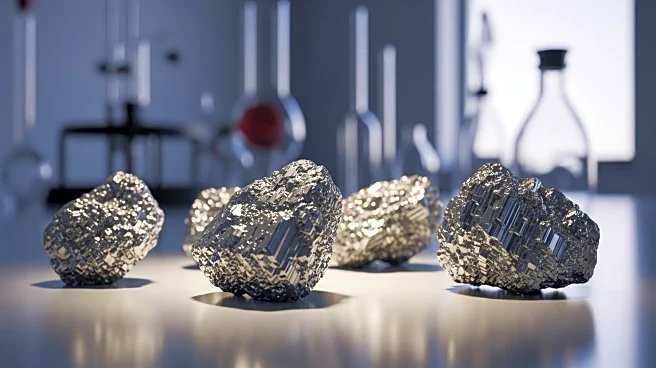

Trigg Minerals has entered into a binding agreement with Wyoming Mines to acquire the Central Idaho Antimony Project, expanding its portfolio of critical minerals in the US. The acquisition involves a payment of $4.97 million in milestone payments. Trigg has also raised $5 million through share issuance to Tribeca Investment Partners. The funds will support Trigg's US operations, potential mainboard listing, and working capital needs.

Why It's Important?

This acquisition is significant as it strengthens Trigg Minerals' position in the US critical minerals market, particularly in antimony, which is essential for various industrial applications. The move aligns with global trends towards securing mineral resources amid supply chain challenges. Trigg's expansion could enhance its competitive edge and attract further investment, contributing to the US's strategic mineral independence.

What's Next?

Trigg plans to implement a systematic exploration program to define mineralized zones for drill testing. The completion of the acquisition is subject to due diligence and necessary approvals. The company may consider rebranding to reflect its focus on American mineral assets, potentially increasing its visibility and appeal to investors.

Beyond the Headlines

The acquisition reflects broader geopolitical dynamics, as countries seek to diversify mineral sources away from China, which dominates the supply chain for many critical minerals. Trigg's strategic positioning in North America could play a role in reshaping the global mineral landscape.