What's Happening?

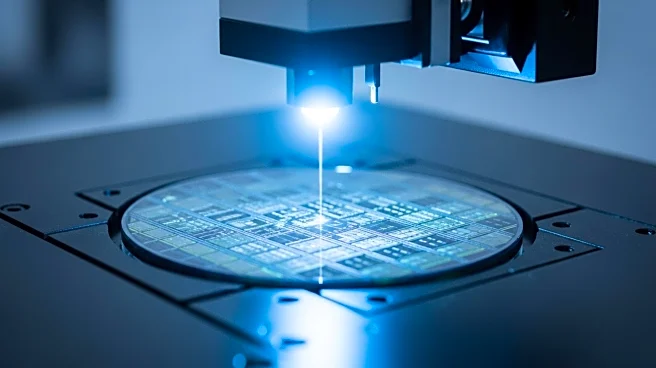

ASML, a leading Dutch technology company specializing in semiconductor manufacturing equipment, has reported stable profits for the third quarter of 2025, with net profits reaching 2.125 billion euros ($2.5 billion). This figure is slightly higher than

the 2.077 billion euros reported in the same quarter last year. Despite the stable financial performance, ASML has issued a warning regarding a significant decline in demand from China in 2026. CEO Christophe Fouquet stated that the company expects a steep fall in China customer demand, which has been strong in 2024 and 2025. The geopolitical and trade tensions have been cited as factors clouding the near-term growth outlook. ASML's third-quarter net sales were 7.5 billion euros, aligning with the company's forecast range of 7.4 billion to 7.9 billion euros. The company anticipates fourth-quarter sales to be between 9.2 and 9.8 billion euros.

Why It's Important?

The anticipated decline in China sales is significant for ASML, as China has been a major market for its semiconductor manufacturing equipment. The U.S.-led export restrictions and geopolitical tensions are likely to impact ASML's business operations and revenue streams. This development could have broader implications for the semiconductor industry, which is already facing challenges due to global supply chain disruptions and trade conflicts. ASML's ability to maintain stable profits despite these challenges highlights its resilience and strategic positioning in the market. However, the decline in China sales could affect the company's growth prospects and necessitate adjustments in its business strategy.

What's Next?

ASML plans to provide more details on its 2026 outlook in January, which will be crucial for stakeholders to understand the company's future direction. The firm is also expecting a 15-percent increase in total net sales for the full year 2025, indicating optimism despite the challenges. The semiconductor industry will be closely monitoring ASML's performance and strategic decisions, as they could influence market dynamics and investment trends. Stakeholders, including investors and industry partners, will be keen to see how ASML navigates the geopolitical landscape and adapts to changing market conditions.

Beyond the Headlines

The situation underscores the complex interplay between technology companies and geopolitical factors. ASML's experience highlights the potential vulnerabilities of global supply chains and the impact of international relations on business operations. The company's strategic decisions in response to these challenges could set precedents for other firms in the semiconductor industry, influencing how they manage risks associated with geopolitical tensions and trade restrictions.