What's Happening?

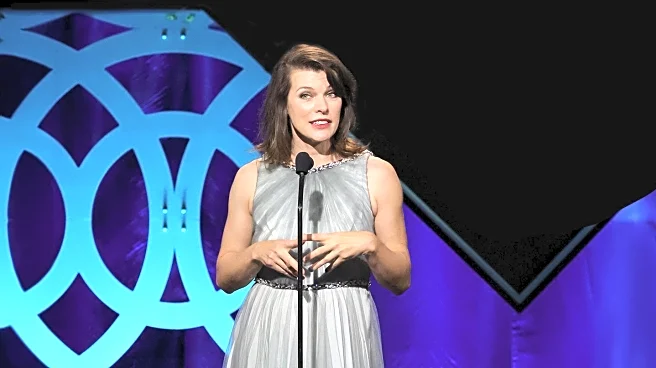

Bitcoin has reached a new record high, surpassing $125,000, as investors appear to be looking beyond the current U.S. government shutdown. This surge is supported by recent gains in U.S. stock markets and increased inflows into bitcoin exchange-traded funds (ETFs). Lale Akoner, a global market analyst at eToro, has identified several catalysts that have contributed to bitcoin's new all-time high. The cryptocurrency's rise is seen as a reflection of investor confidence in digital assets, even amidst political and economic uncertainties.

Why It's Important?

The significant rise in bitcoin's value highlights the growing acceptance and integration of cryptocurrencies into mainstream financial markets. This development could have substantial implications for the U.S. financial industry, as it may encourage more institutional investors to consider digital assets as part of their portfolios. The surge also underscores the resilience of cryptocurrencies in the face of traditional market disruptions, such as government shutdowns. This trend could potentially lead to increased regulatory scrutiny as authorities seek to understand and manage the impact of digital currencies on the broader economy.

What's Next?

As bitcoin continues to gain traction, market analysts and investors will be closely monitoring the regulatory landscape and potential policy changes that could affect the cryptocurrency market. The ongoing government shutdown may also influence investor behavior and market dynamics in the short term. Additionally, the performance of bitcoin ETFs and their role in driving demand for the cryptocurrency will be a key area of focus for stakeholders.

Beyond the Headlines

The rise of bitcoin to new heights may also prompt discussions about the environmental impact of cryptocurrency mining, as well as the need for sustainable practices within the industry. Furthermore, the increasing popularity of digital currencies could lead to broader societal shifts in how value is perceived and exchanged, challenging traditional financial systems and institutions.