What is the story about?

What's Happening?

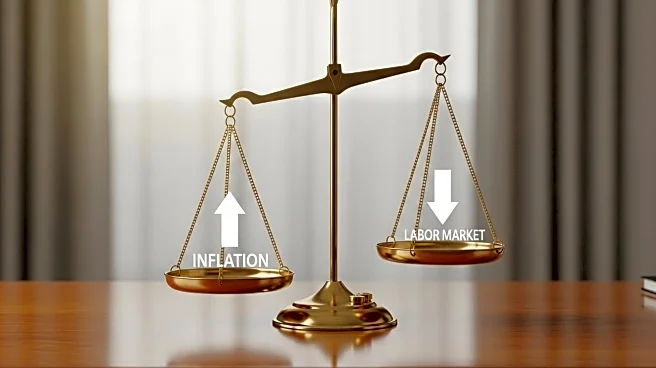

The U.S. Federal Reserve is facing a challenging policy environment in 2025, driven by weak labor market data and persistent core inflation. Recent reports indicate that nonfarm payrolls increased by only 22,000 in August, significantly below expectations, while the unemployment rate rose to 4.3%. This labor market fragility is compounded by sectoral job losses in manufacturing and government, contrasting with gains in healthcare. Wage growth has slowed to 3.7% year-over-year, marking its weakest pace in over a year. Meanwhile, core inflation remains stubbornly high at 3.1% year-over-year, despite headline inflation moderating to 2.7% due to falling energy prices. These economic indicators have led markets to price in a 67% chance of a 25-basis-point rate cut by the Federal Reserve in September, as the central bank seeks to balance supporting the labor market with controlling inflation.

Why It's Important?

The potential rate cut by the Federal Reserve is significant as it could reshape investment strategies across various asset classes. A reduction in interest rates typically lowers borrowing costs, which can stimulate economic activity but also risks prolonging inflationary pressures. The decision is crucial for sectors like healthcare and utilities, which may benefit from defensive strategies amid inflation concerns. Additionally, the appointment of Stephen Miran to the Fed's governing board, known for advocating economic resilience, could influence the central bank's policy direction. Investors are already adjusting portfolios, moving away from cash and short-term assets towards bonds and alternatives, anticipating lower yields. The Fed's actions will have broad implications for the U.S. economy, affecting everything from consumer spending to corporate investment decisions.

What's Next?

If the Federal Reserve proceeds with the rate cut, it will mark a significant shift from its previous tightening cycle. Analysts suggest that the central bank may act sooner than expected to mitigate economic risks, particularly as labor market momentum continues to weaken. The Fed's decision will be closely watched by investors and policymakers, as it will set the tone for monetary policy for the remainder of 2025. The central bank's ability to navigate the delicate balance between supporting employment and controlling inflation will be critical in maintaining economic stability. Market participants will remain focused on upcoming economic data releases and Fed communications to gauge future policy moves.