What's Happening?

Semiconductor Manufacturing International Corp (SMIC), China's largest contract chipmaker, is experiencing a decline in its stock value due to concerns over a potential shortage of memory chips. This has

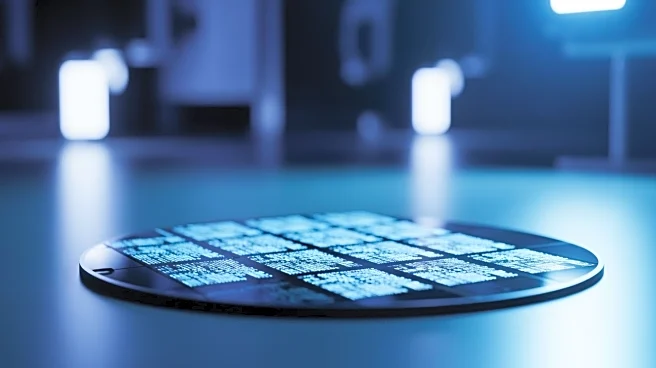

led customers to delay their orders for the first quarter of the next year. The company's Hong Kong shares fell by 2.9%, marking the largest one-day percentage drop since October 31, while its Shanghai-listed stock decreased by 1.9%. Despite these challenges, SMIC reported a 4.6% increase in wafer shipments in the third quarter compared to the second quarter. The company has seen significant stock growth year-to-date, with Hong Kong shares up 136% and Shanghai shares up 27.8%.

Why It's Important?

The potential shortage of memory chips poses a significant risk to industries reliant on these components, such as automotive and smartphone manufacturers. These sectors may face pricing pressures and supply uncertainties, which could impact production and profitability. The situation highlights the broader challenges in the global semiconductor supply chain, exacerbated by geopolitical tensions and trade restrictions. Companies like SMIC play a crucial role in the tech industry, and disruptions in their operations can have ripple effects across various sectors, affecting economic stability and technological advancement.