What's Happening?

Gold futures opened at $4,371 per ounce on Tuesday, marking a 0.8% increase from the previous day's close. This rise is part of a broader trend, with gold prices up 5.8% from a week ago and 19.5% over

the past month. The surge in gold prices is linked to ongoing U.S.-China trade tensions, particularly concerning rare earth minerals. China, which produces over two-thirds of the world's supply of these minerals, has expanded export restrictions. In response, President Trump has threatened new tariffs and signed a deal with Australia to secure rare earths for the U.S., bypassing China's control. Cleveland-Cliffs, a domestic steel company, has also announced plans to excavate these materials, although the timeline remains uncertain.

Why It's Important?

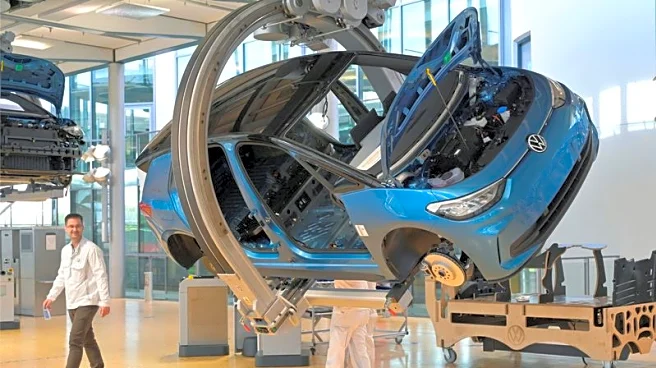

The increase in gold prices reflects heightened demand driven by geopolitical tensions, particularly between the U.S. and China. Rare earth minerals are crucial for manufacturing computer chips, and China's dominance in this sector has been a significant leverage point in trade negotiations. The U.S.'s efforts to secure alternative sources of these minerals could reduce dependency on China, potentially altering global supply chains. For investors, gold is seen as a safe haven during times of economic uncertainty, and its rising price indicates increased market volatility. The situation could impact industries reliant on rare earths, such as technology and manufacturing, and influence broader economic policies.

What's Next?

The U.S.-China trade tensions are likely to continue influencing gold prices and market dynamics. As the U.S. seeks to diversify its sources of rare earth minerals, further deals and domestic initiatives may emerge. Stakeholders, including investors and industries dependent on these materials, will be closely monitoring developments. Potential retaliatory measures from China could escalate the situation, affecting global trade and economic stability. The ongoing negotiations and strategic moves by both countries will be critical in shaping future market conditions.

Beyond the Headlines

The geopolitical struggle over rare earth minerals highlights broader issues of resource control and economic power. As countries vie for dominance in critical sectors, ethical considerations regarding environmental impact and labor practices in mining these materials may come to the forefront. Long-term shifts in global trade policies and alliances could result from these tensions, influencing international relations and economic strategies.