What's Happening?

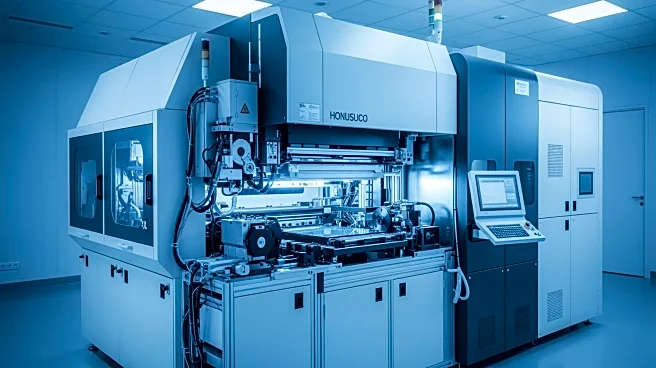

Shares of Suss Microtec have risen for a third consecutive session, increasing by 11.5% following a series of analyst upgrades. Jefferies and UBS have both upgraded the semiconductor equipment manufacturer

to 'buy' from previous ratings of 'hold' and 'neutral', respectively. The upgrades are attributed to an improving outlook for AI demand and significant investment announcements. Jefferies highlights a rise in orders from a Q3 'bottom', with management forecasting a substantial increase in order intake for Q4. UBS anticipates that the company's upcoming capital markets day on November 17 could serve as a positive catalyst, potentially setting mid-term targets. Deutsche Bank also recently upgraded the stock, citing similar reasons. Currently, out of 11 analysts covering Suss Microtec, eight rate it as 'strong buy' or 'buy', two as 'hold', and one as 'strong sell'.

Why It's Important?

The upgrades and positive outlook for Suss Microtec are significant as they reflect broader trends in the semiconductor industry, particularly the growing demand for AI technologies. This demand is driving investment and optimism among analysts, which could lead to increased investor confidence and stock performance. The semiconductor sector is crucial for technological advancements and economic growth, and positive developments in companies like Suss Microtec can have ripple effects across the industry. Investors and stakeholders in the semiconductor market stand to benefit from these upgrades, as they suggest potential growth and profitability in the near term.

What's Next?

Suss Microtec's upcoming capital markets day on November 17 is expected to be a key event, potentially providing further insights into the company's mid-term targets and strategic direction. Analysts and investors will be closely monitoring this event for any announcements that could impact stock performance. Additionally, continued improvements in AI demand and investment could further bolster the company's outlook and attract more positive analyst ratings. Stakeholders will be watching for any changes in order intake and management guidance that could influence future stock movements.

Beyond the Headlines

The analyst upgrades and positive outlook for Suss Microtec highlight the increasing importance of AI technologies in the semiconductor industry. As companies invest in AI capabilities, there are potential ethical and cultural implications, such as the impact on employment and the need for responsible AI development. The focus on AI demand also underscores the industry's shift towards more advanced and specialized technologies, which could lead to long-term shifts in market dynamics and competitive landscapes.