What is the story about?

What's Happening?

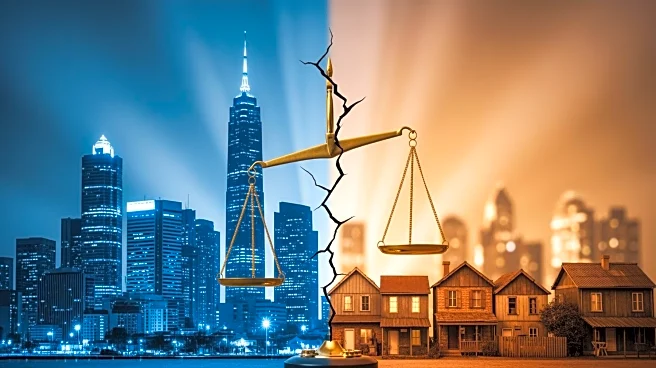

World Liberty Financial (WLFI), a crypto venture linked to the Trump family, is facing backlash after freezing token holdings of major investors, including Justin Sun. Sun accused WLFI of blacklisting his tokens following a $9 million transaction, challenging the project's claims of decentralized governance. Other investors have reported similar issues, with compliance systems flagging wallets as high risk, leading to token lockups. The controversy raises questions about the governance and transparency of WLFI, which markets itself as a decentralized alternative to traditional finance.

Why It's Important?

The backlash against WLFI highlights the challenges of governance and compliance in the crypto industry, particularly for projects claiming decentralization. The incident underscores the risks of centralized control mechanisms, which can undermine investor trust and the utility of blockchain technology. The Trump family's involvement adds a layer of complexity, as their regulatory stance on crypto could influence the project's future. The situation may impact investor confidence in WLFI and similar ventures, potentially affecting the broader perception of crypto as a decentralized financial solution.

What's Next?

As the situation unfolds, investors and observers will be watching for WLFI's response to the allegations and whether it can reconcile its decentralized claims with its operational practices. The project's governance model and market performance will be scrutinized, with potential regulatory developments shaping its trajectory. The Trump family's role in WLFI may attract further attention, influencing debates on the intersection of politics, regulation, and decentralized finance.