What's Happening?

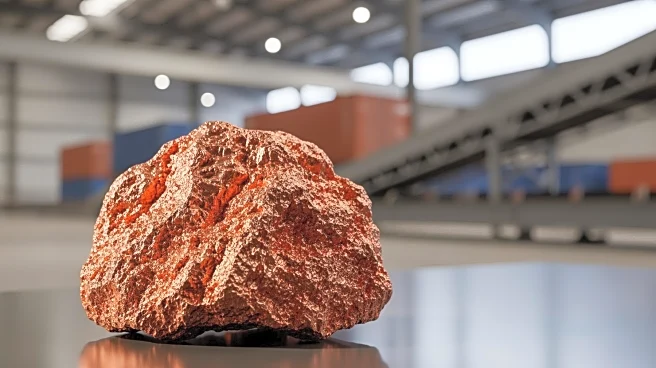

The Democratic Republic of Congo is set to send its first shipment of copper to the United States through a strategic partnership with Mercuria Energy Group. This move is part of an effort by the Trump administration to counter China's dominance in the supply

of key metals. Congo's state miner, Gecamines, will ship 100,000 tons of copper from its 20% share of production at the Tenke Fungurume mining project. This initiative is part of a broader strategic partnership signed with Washington, aiming to provide the U.S. with access to Congo's mining and infrastructure projects. In exchange, the U.S. is expected to support Congo in addressing a rebellion backed by neighboring Rwanda. The partnership with Mercuria, which was announced in October, involves financial, logistical, and technical support from the energy group. The U.S. International Development Finance Corp. has also expressed interest in taking a financial stake in the venture, potentially giving U.S. end users the right of first refusal on the materials sold.

Why It's Important?

This development is significant as it represents a strategic shift in the global copper supply chain, potentially reducing China's influence over the market. By securing a direct supply of copper from Congo, the U.S. aims to bolster its access to essential raw materials needed for various industries, including technology and renewable energy. This move could enhance the U.S.'s geopolitical leverage and economic security by diversifying its sources of critical minerals. Additionally, the partnership may lead to increased investment in Congo's mining sector, potentially boosting the local economy and infrastructure. However, it also raises questions about the geopolitical dynamics in the region, particularly concerning China's existing influence and the ongoing conflict involving Rwanda.

What's Next?

The partnership between Congo and Mercuria is expected to expand, with Gecamines aiming for sales rights of up to 500,000 tons of copper and 40,000 tons of cobalt annually. The U.S. International Development Finance Corp.'s potential financial involvement could further solidify the U.S.'s stake in Congo's mining sector. As the partnership develops, it may prompt reactions from China, which currently dominates the mining and processing of Congo's copper and cobalt. The U.S. may also need to navigate the complex political landscape in Congo, balancing its strategic interests with the need to support stability and development in the region.