What's Happening?

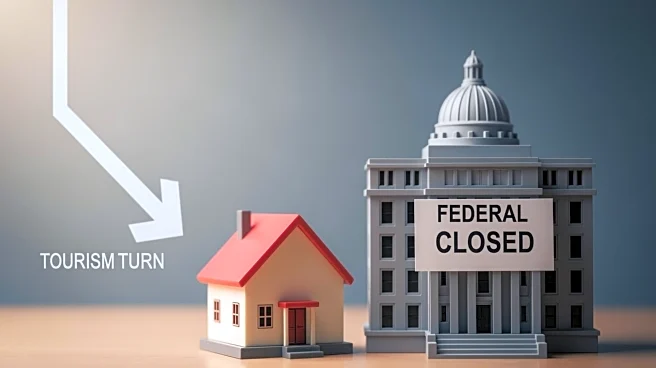

Nevada's housing market is experiencing strain due to the ongoing federal government shutdown and a slump in tourism. The state, heavily reliant on real estate as an economic driver, is ranked among the most vulnerable to housing-related fallout. Inventory

in Las Vegas has increased by 40% year over year, with homes sitting longer on the market and price cuts becoming more common. The tourism decline further exacerbates the situation, affecting consumer confidence and shrinking the buyer pool.

Why It's Important?

The challenges facing Nevada's housing market have significant implications for the state's economy, which relies heavily on real estate and tourism. The slowdown in these sectors can lead to job losses and reduced economic activity, impacting local businesses and government revenue. The situation highlights the interconnectedness of various economic factors and the importance of stability in maintaining market confidence.

What's Next?

If the federal shutdown continues, Nevada's housing market may face further setbacks, with potential delays in loan processing and increased uncertainty among buyers. Stakeholders, including real estate agents and policymakers, may need to implement strategies to mitigate the impact and support the market. The tourism sector may also require targeted efforts to boost visitor numbers and restore consumer confidence.

Beyond the Headlines

The situation in Nevada underscores the broader economic vulnerabilities that can arise from political and environmental factors. The reliance on tourism and real estate highlights the need for diversification in the state's economic strategy to withstand future disruptions.