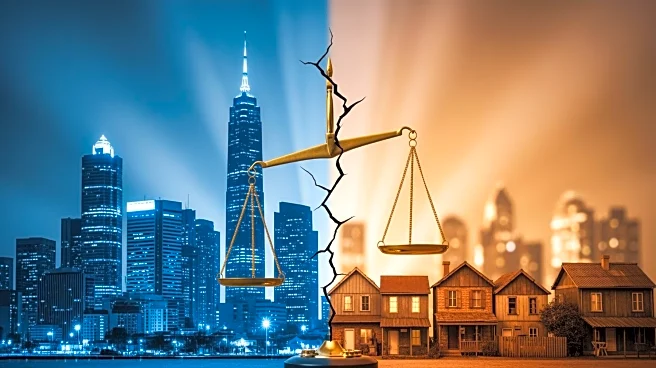

What's Happening?

Insurance companies operating across state lines face significant legal challenges due to varying state laws. These challenges arise from differences in how states interpret insurance policies and handle claims. For instance, the choice of law can affect

the outcome of claims, as different states may apply different legal standards. Some states follow the 'most significant relationship' test, while others have specific statutes requiring the application of their laws. This complexity is further compounded when insurers must navigate issues like pollution exclusions and the requirement to prove prejudice in claims handling.

Why It's Important?

The legal complexities faced by insurers can have substantial financial and operational implications. Missteps in applying the correct state law can lead to costly litigation and damage to an insurer's reputation. This situation necessitates that insurers have robust legal strategies and knowledgeable legal teams to navigate these challenges effectively. The ability to manage these legal intricacies is crucial for maintaining compliance and ensuring fair treatment of policyholders. Additionally, these challenges highlight the need for potential regulatory reforms to harmonize insurance laws across states, which could simplify operations for insurers and provide more consistent protection for consumers.