What's Happening?

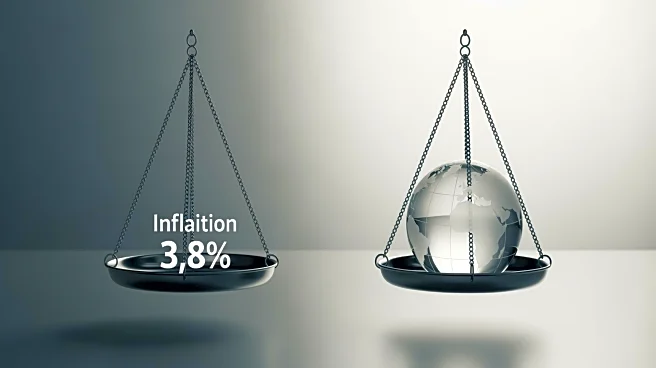

The UK's inflation rate remained at 3.8% in September, defying expectations of an increase. Despite this stability, consumer confidence remains fragile due to ongoing cost-of-living pressures. Food inflation,

although slowing, continues to outpace general inflation, affecting household budgets. The flat inflation rate offers some relief, but concerns persist about the impact on consumer spending and economic stability.

Why It's Important?

The steady inflation rate provides a temporary reprieve for households and retailers, but the cost-of-living crisis continues to strain finances. Consumer confidence is crucial for economic growth, and the current fragility may lead to reduced spending, affecting retail and other sectors. The upcoming Autumn Budget will be pivotal in addressing these challenges, influencing business costs and consumer behavior. Retailers must adapt to changing consumer priorities, focusing on value and competitive pricing to maintain sales.

What's Next?

Retailers are likely to face a challenging holiday season as consumers prioritize essential spending and seek value. The Autumn Budget will play a critical role in shaping economic policies that impact consumer confidence and business operations. Retailers may need to enhance promotional activities and customer loyalty programs to attract cautious shoppers. Monitoring inflation trends and consumer sentiment will be essential for businesses to navigate the economic landscape effectively.

Beyond the Headlines

The inflation data underscores the broader economic challenges facing the UK, including income disparities and financial insecurity. The situation highlights the need for comprehensive policy measures to address the root causes of economic fragility and support vulnerable households. Long-term strategies may involve enhancing social safety nets and promoting sustainable economic growth to ensure stability and resilience.