What's Happening?

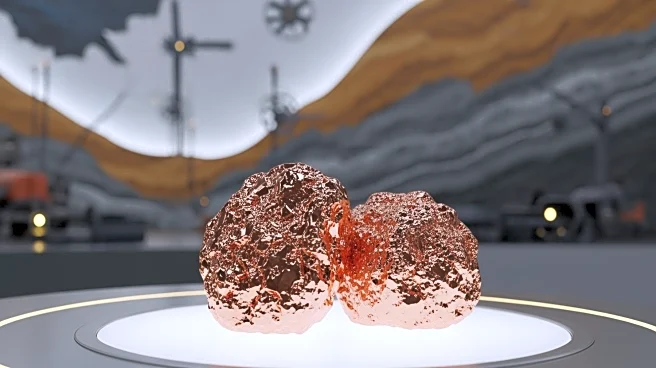

China's CMOC Group has announced a significant investment of $1.08 billion to expand its KFM copper mine located in the Democratic Republic of Congo (DRC). This expansion aims to increase the mine's annual output by approximately 100,000 metric tons.

The project is set to enter its second phase in 2027, following the first phase reaching full capacity in 2023. This move comes at a time when global copper supplies are under pressure due to disruptions in mining operations worldwide, including the suspension of Freeport's Grasberg project in Indonesia. CMOC, which owns a 71.25% stake in KFM through its Hong Kong-based subsidiary, also operates the Tenke Fungurume mine in the DRC. Both mines are crucial suppliers of copper and cobalt, essential metals for the energy transition. Despite the promising expansion, CMOC has cautioned about potential risks associated with price fluctuations and the political and economic instability in the DRC.

Why It's Important?

The expansion of the KFM copper mine by CMOC is a strategic move to bolster its position in the global copper market, especially as the demand for copper and cobalt rises with the global shift towards renewable energy and electric vehicles. The investment highlights the critical role of the DRC in the global supply chain for these essential metals. However, the project also underscores the challenges faced by mining companies operating in politically and economically unstable regions. The potential risks of price volatility and regional instability could impact the profitability and sustainability of such large-scale investments. For the U.S. and other global stakeholders, the expansion could influence copper prices and availability, affecting industries reliant on these metals.

What's Next?

As CMOC progresses with the expansion, stakeholders will closely monitor the political and economic developments in the DRC, which could affect the project's timeline and success. The global market will also watch for any shifts in copper prices as the expansion aims to address supply shortages. Additionally, other mining companies may consider similar investments or expansions to capitalize on the growing demand for copper and cobalt, potentially leading to increased competition and innovation in the sector.

Beyond the Headlines

The expansion of the KFM mine could have broader implications for the DRC, potentially leading to increased economic activity and job creation in the region. However, it also raises questions about the environmental and social impacts of mining operations in the area. The project may prompt discussions on sustainable mining practices and the need for regulatory frameworks to ensure that the benefits of such investments are equitably distributed among local communities.