What's Happening?

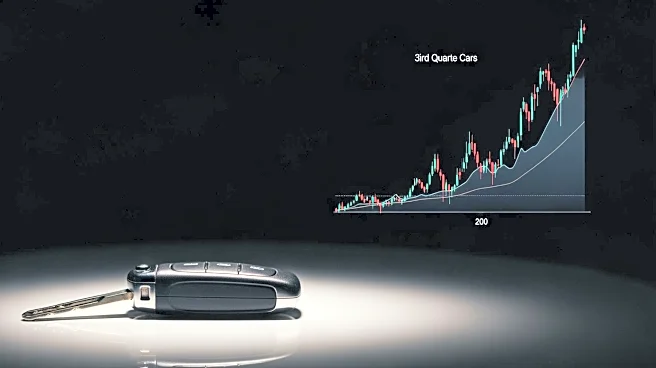

Volvo Cars, owned by China's Geely Holding, reported a stronger-than-expected third-quarter profit, leading to a 40% surge in its stock price. The company posted an operating income of 6.4 billion Swedish kronor, surpassing analysts' expectations. This

performance was driven by an 18 billion kronor cost-saving program and certain one-off items. The company's EBIT margin improved to 7.4%, up from 6.2% the previous year. Volvo Cars is ramping up sales of its BEV cars and is on track for the January launch of the EX60.

Why It's Important?

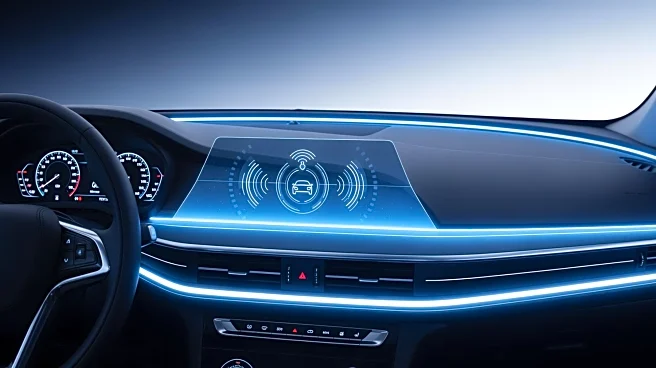

Volvo Cars' impressive financial performance underscores the effectiveness of its cost-saving measures and strategic focus on electric vehicles (EVs). The significant stock price increase reflects investor confidence in the company's growth trajectory, particularly in the EV market. As the automotive industry faces macroeconomic challenges, including price competition and U.S. import tariffs, Volvo's ability to maintain profitability and expand its EV offerings positions it well for future success. The company's focus on cost efficiency and innovation in EVs is likely to influence industry trends and competitive dynamics.

What's Next?

Volvo Cars anticipates further positive effects from its cost-cutting initiatives in the coming months. However, the company acknowledges the challenging short-term outlook due to persistent macroeconomic issues. The upcoming launch of the EX60 in January is a critical milestone for Volvo, as it seeks to strengthen its position in the popular electric vehicle segment. The company's performance and strategic decisions will be closely watched by industry stakeholders and investors, as they could set benchmarks for other automakers navigating similar challenges.